08 Apr 20220406 Trade Review DAX

Posted at 05:20h

in DAX Trade Review, Late-Sustained Auction Entry, Sustained Auction, Trade Reviews

0 Comments

Play: Late-Sustained Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- 0.4R

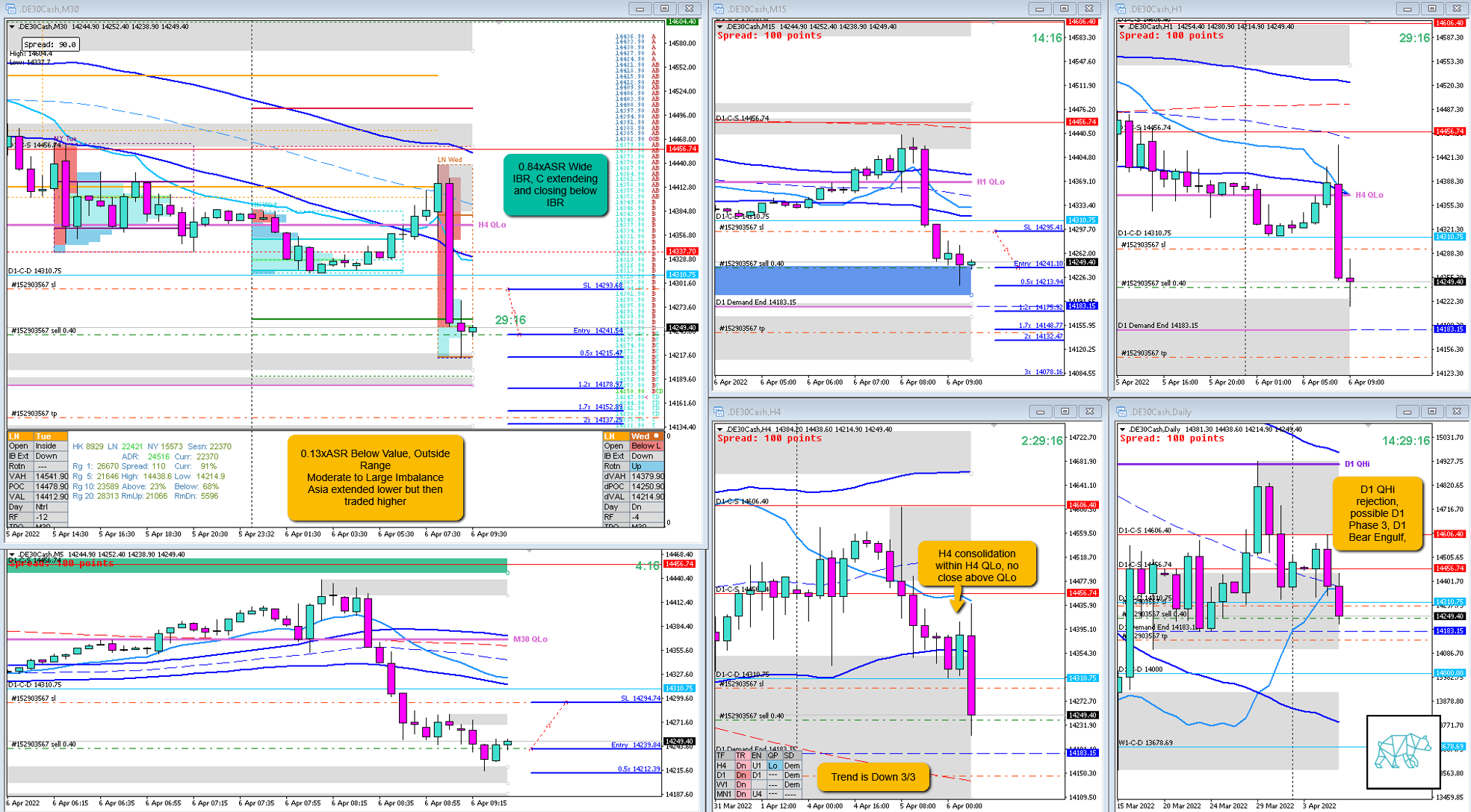

- Open Sentiment

- 0.13xASR Below Value, Outside Range

- Moderate to Large Imbalance

- Asia extended lower but then traded higher

- IBR

- 0.84xASR Wide IBR

- Trend

- Strong DT

- H4: Down

- D1: Down

- W1: Down

- Hypo

- Hypo 3

- Short

- Late-Sustained Auction

- Attempted Setup

- Late-Sustained Auction

- Entry Technique

- C TPO extended and closed below IBR, pullback to IB low

- SL placement

- Average SL (5000)

- TPO period for Entry

- C TPO

- Trade Duration

- 1h42m

- Long/Short

- Short

- Leading Narrative

- D1 QHi rejection, possible D1 Phase 3,

- Prev. Day Exceeded ADR by 1.08 closing as Bear Engulf, possible momentum

- Open sentiment

- Extension and close below during C TPO

Actual Development

- E formed a DBD, F a Bullish Inside Bar, all closing below IB in effect sustaining the auction

- G finally made a LL, then H and I closed lower

Good points

- Taking the trade even though a wide IBR usually infers a low possibility of a sustained auction. But due to the possibility of momentum coming from a D1 Bear Engulf and prev. Day having exceeded ADR I went with a bearish narrative.

Bad Points

- I could have let my target take over as it would have been hit. G TPO had made a LL so there was an additional sign of a continued sustained auction. It being around 2nd DTTZ I thought there could be a reversal coming and grasshoppered out of the trade for a measly 0.4R.

Next Day Analysis

- Target hit?

- No, 0.4R

- Time-based Exit?

- 0.6R

- Overlap Noise?

- 1.5R

- End of Day?

- 1.8R

- Highest R multiple?

- 4.2R

TAGS: Below Value, Outside Range, Moderate to Large Imbalance, Wide IBR, Trend is Down 3/3,

Premarket prep on the day:

Daily Report Card:

No Comments