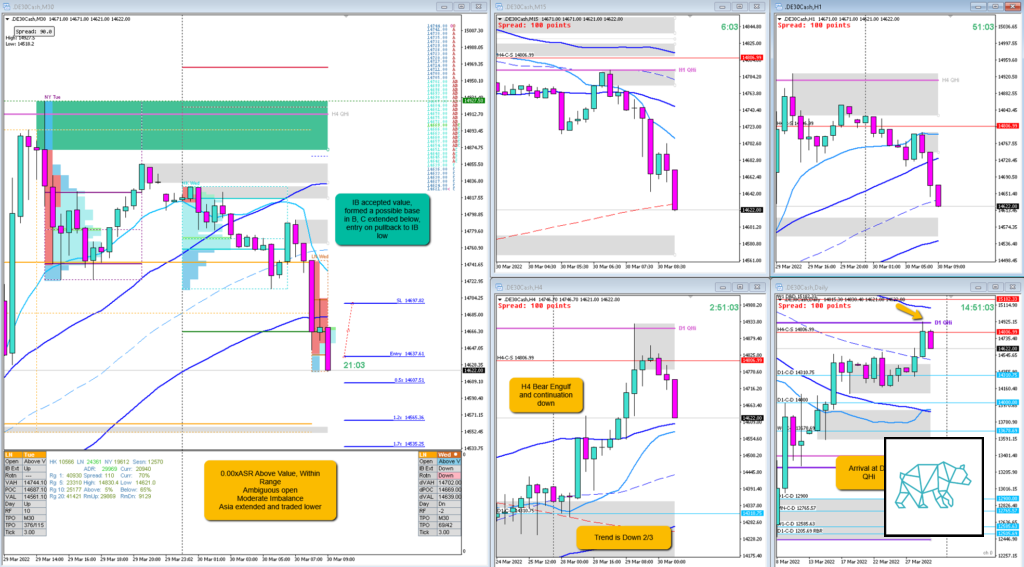

Play: Value Acceptance, Sustained Auction T1 & T2

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- 1.2R

- 2nd trade: 0.5R

- Open Sentiment

- 0.00xASR Above Value, Within Range

- Ambiguous open

- Moderate Imbalance

- Asia extended and traded lower

- IBR

- 0.43xASR Normal IBR, accepted value during A, formed a base during B TPO

- Trend

- Trend is Down 2/3

- H4: Up

- D1: Down

- W1: Down

- Hypo

- 1

- Short

- Value Acceptance, possible continuation after rotation

- 2nd trade: same hypo 1 narrative

- Attempted Setup

- Sustained Auction

- Entry Technique

- Break of IB, pullback to test IB low

- 2nd trade: low initiative sustained auction, pop to the downside making a LL, M5 closing as a Bear Engulf

- SL placement

- Standard SL (6000)

- 2nd trade: Standard SL (6000)

- TPO period for Entry

- C TPO

- 2nd trade: G TPO

- Trade Duration

- 1h54m

- 2nd trade: 0h1m

- Long/Short

- Short

- Leading Narrative

- Open Sentiment and value acceptance

- Asia Extended and closed down, possible unidirectional day coming from D1 QHi in a downtrend

- H4 Bear Engulf at D1 QHi and developing continuation

- Trend is Down 2/3

- 2nd entry: price rotated through value indicating a possible further continuation lower, price pulled back to IB low and I went short for a 2nd time.

T1 Exit

T2 Exit

Actual Development

- C closed below IB, D formed a Hammer, E and F pulled back inching higher to IB low without making a LL but not closing within IB, technically sustaining the auction

Good points

- Understanding the narrative

- Getting in on a 2nd trade for the same setup

Bad Points

- Fumbled FX Synergy on he first trade again. I should’ve been stalking the trade a bit earlier but I had just finished writing my preps.

- Could’ve let the 2nd trade go on longer

Next Day Analysis

- Target hit?

- Yes, 1.2R

- 2nd trade: No, 0.5R

- Time-based Exit?

- 0.3R

- 2nd trade: 0.1R

- Overlap Noise?

- 0.5R

- 2nd trade: 0.3R

- End of Day?

- 0.7R

- 2nd trade: 0.5R

- Highest R multiple?

- 1.9R

- 2nd trade: 1.7R

TAGS: Above Value, Within Range, Moderate Imbalance, Ambiguous Open, Trend is Down 2/3,

Premarket prep on the day:

Daily Report Card: