Play: Return to Value, Reversal

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- 1.2R

- Open Sentiment

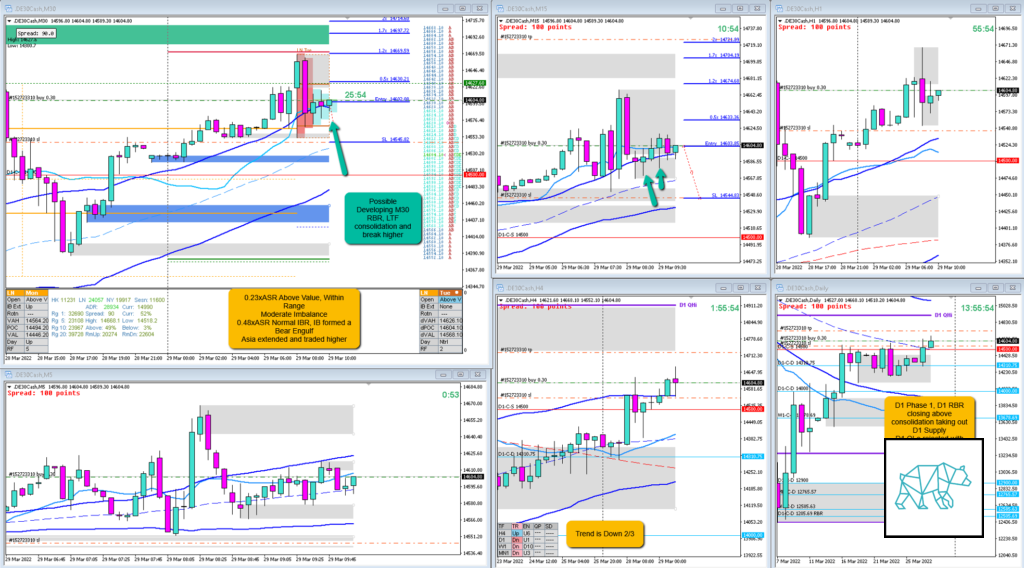

- 0.23xASR Above Value, Within Range

- Moderate Imbalance

- Asia extended and traded higher

- IBR

- 0.48xASR Normal IBR, IB formed a Bear Engulf

- Trend

- Trend is Down 2/3

- H4: Up

- D1: Down

- W1: Down

- Hypo

- 2

- Long

- Return to Value, VAH Reversal, risky with bear engulf right above, perhaps best for price to clear that first

- Possible Failed Auction

- Attempted Setup

- Reversal

- Entry Technique

- Possible developing M30 RBR above VAH

- M15 demand created with longer buying wicks

- SL placement

- Standard SL (6000)

- TPO period for Entry

- E TPO

- Trade Duration

- 0h04m

- Long/Short

- Long

- Leading Narrative

- D1 Phase 1, D1 RBR closing above consolidation taking out D1 Supply, possible continuation higher

- D1 QLo rejected with price trading mid swing ie. no arrival at D1 QHi (yet)

- Prev. Day Exceeded ADR 1.16 (possible momentum)

- Open Sentiment

- Developing M30 RBR, LTF consolidation and break higher

- Gold having a Sustained Auction Down

Actual Development

- E TPO quickly burst higher extending above IBR hitting target

Good points

- Understanding the higher/medium timeframe narrative

- Understanding the inverse correlation with Gold

- Understanding the countertrend correlation in both asset classes

- Going against the Bear Engulf formed during IB (rare though and risky)

Bad Points

- Trade hit 2R in the next TPO

Next Day Analysis

- Target hit?

- Yes, 1.2R

- Time-based Exit?

- 1.7R

- Overlap Noise?

- 0.5R

- End of Day?

- 4.2R

- Highest R multiple?

- 5R

TAGS: Above Value, Within Range, Moderate Imbalance, Trend is Down 2/3, Prev. Day Exceeded ADR, Inverse Asset Correlation,

Premarket prep on the day:

Daily Report Card: