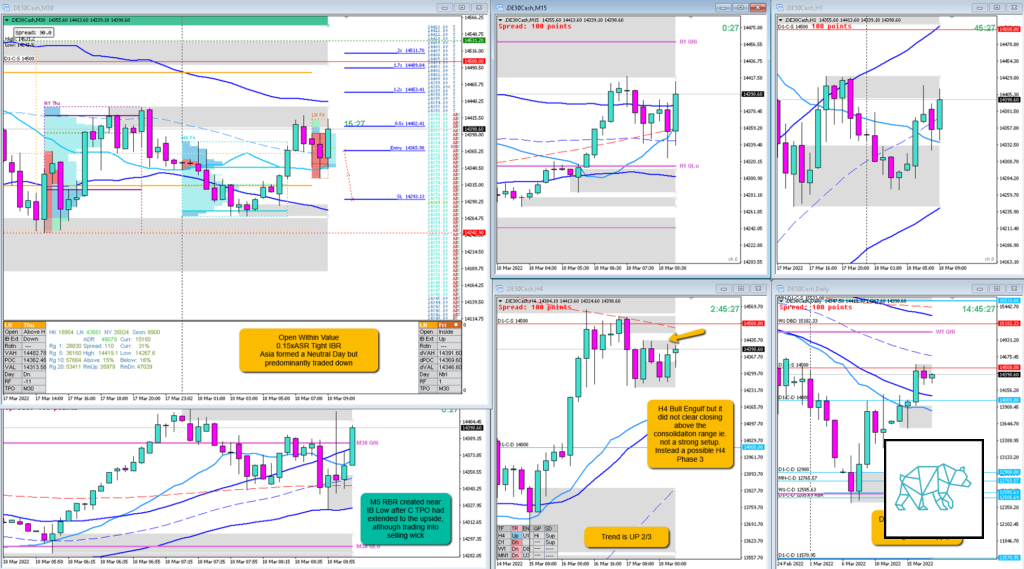

Play: Strength From Within IBR

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- -0.7R

- Open Sentiment

- Open Within Value

- Asia formed a Neutral Day but predominantly traded down

- IBR

- 0.15xASR Tight IBR

- Trend

- Trend is Down 2/3

- H4: Up

- D1: Down

- W1: Down

- Hypo

- Hypo 1

- Long

- Late-Sustained Auction, possible Strength From Within IBR

- Attempted Setup

- Strength From Within IBR

- Entry Technique

- M5 RBR created near IB low after C TPO had extended to the upside

- SL placement

- Risk-Adjusted SL at (7000)

- TPO period for Entry

- C TPO

- Trade Duration

- 0h20m

- Long/Short

- Long

- Leading Narrative

- Possible D1 RBR

- H4 Bull Engulf

- Extension to the upside

Actual Development

- C TPO closed confidently down near IB Low. Expected an extension to the downside which would negate my long thesis.

- Took the trade off when D TPO extended to the downside forming a Neutral Day, possible 3‑I day for ‑0.7R

Good points

- Trying a trade

Bad Points

- H4 Bull Engulf had not closed above the consolidation range indicating a possible lack of initiative into that direction. Possible H4 Phase 3

- FX synergy did not copy the trade over, but did to the live account. Trying to troubleshoot with FX Synergy.

Next Day Analysis

- Target hit?

- No, ‑0.7R

- Time-based Exit?

- -1R

- Overlap Noise?

- -1R

- End of Day?

- -1R

- Highest R multiple?

- 0.5R

TAGS: Open Within Value, Trend is Down 2/3,

Premarket prep on the day:

Daily Report Card: