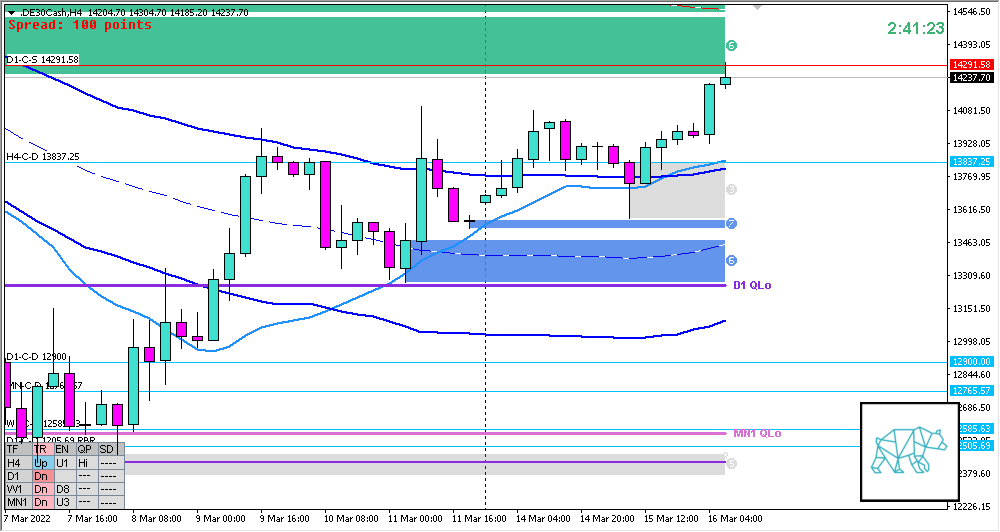

16 Mar 20220316 Premarket Prep DAX

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #index #indices #DAX #DE30Cash

This is my premarket prep for today’s European session for DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Larger Timeframe

- MN

- Price trading below last month’s range and started reacting off MN QLo and MN Demand

- W1

- W1 reacted off W1 QLo and W1 demand closing as a Bullish Inside Bar (weekend overlap trading added)

- Price trading above last week’s body but still within range

Narrative

- D1

- D1 closed higher as a Hammer

- D1 QLo rejected, price trading mid swing

- Price returned to D1 Supply Base level

- H4

- H4 Bull Engulf at H4 VWAP in UT giving H4-C‑D 13837.25 (at VAH)

- Price took out H4 supply (at round number)

- Trend

- Trend is Down 2/3

- Market Profile

- Value created below the previous

- LN Open

- 0.85xASR Above Value, Outside Range

- Large Imbalance

- Open at D1 Supply

- 0.25xASR Tight IBR

- Asia formed a Neutral Day

Hypos

- Hypo 1

- Short

- Mean Reversion, Sustained Auction

- Hypo 2

- Long

- Return to Value, possible LTF demand, possible reversal or Auction Fade

- Hypo 3

- Short

- Reversal, possibly at ADR exhaustion

Clarity

- 2

Additional notes

- Fed Rate Decision tomorrow. Might not see much happening.

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- No early exits, either hit SL or target

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING

No Comments