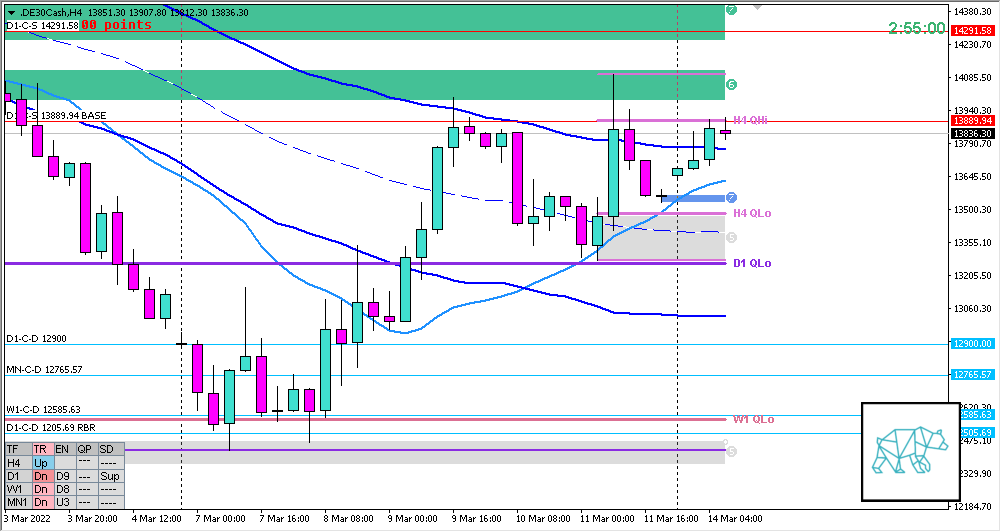

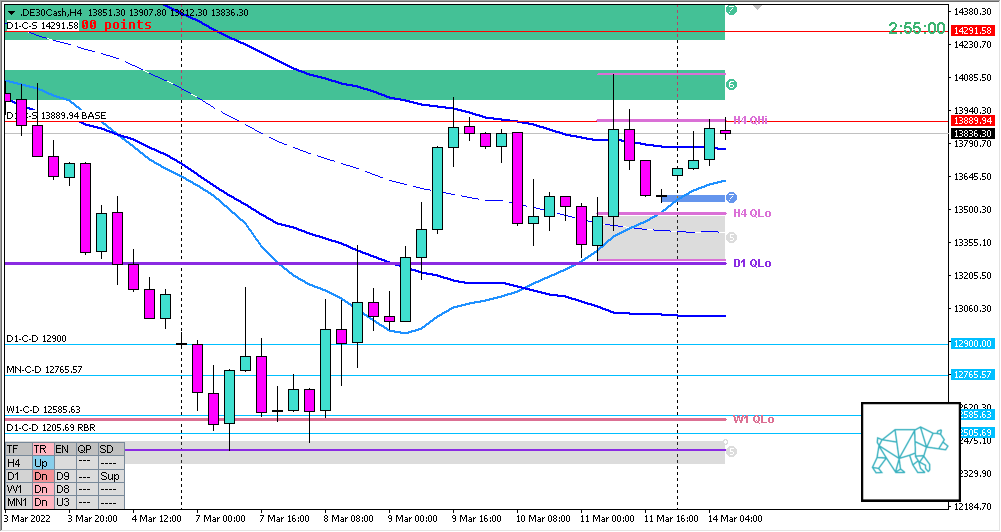

14 Mar 20220314 Premarket Prep DAX

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #index #indices #DAX #DE30Cash

This is my premarket prep for today’s European session for DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Larger Timeframe

- MN

- Price trading below last month’s range and started reacting off MN QLo and MN Demand

- W1

- W1 reacted off W1 QLo and W1 demand closing as a Bullish Inside Bar (weekend overlap trading added)

Narrative

- D1

- D1 QLo rejected

- D1 trading at D1 VWAP in DT

- Price retraced to D1 Base Supply level

- Prev. Day Exceeded ADR by 1.25

- H4

- H4 Three Inside DOwn with no continuation, instead some demand created at H4 VWAP in UT

- Trend

- Trend is Down 2/3

- H4: UP

- D1: Down

- W1: Down

- Market Profile

- 3 overlapping values with the last being wider than usual

- LN Open

- Open Within Value

- Balancing Market

- Asia extended higher but pulled back within IBR

- 0.21xASR Tight IBR

Hypos

- Hypo 1

- Short

- Reversal, possibly at ADR 0.5, possible Failed Auction, possible 3‑I Day

- Hypo 2

- Long

- Late-Sustained Auction, preferably closing above VAH as well

- Hypo 3

- Short

- Auction Fade

Clarity

- 3

Additional notes

- N.A.

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- No early exits, either hit SL or target

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING

No Comments