11 Mar 20220310 Trade Review DAX

Play: Value Acceptance, Weakness From Within IBR (prior extension)

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- 1R

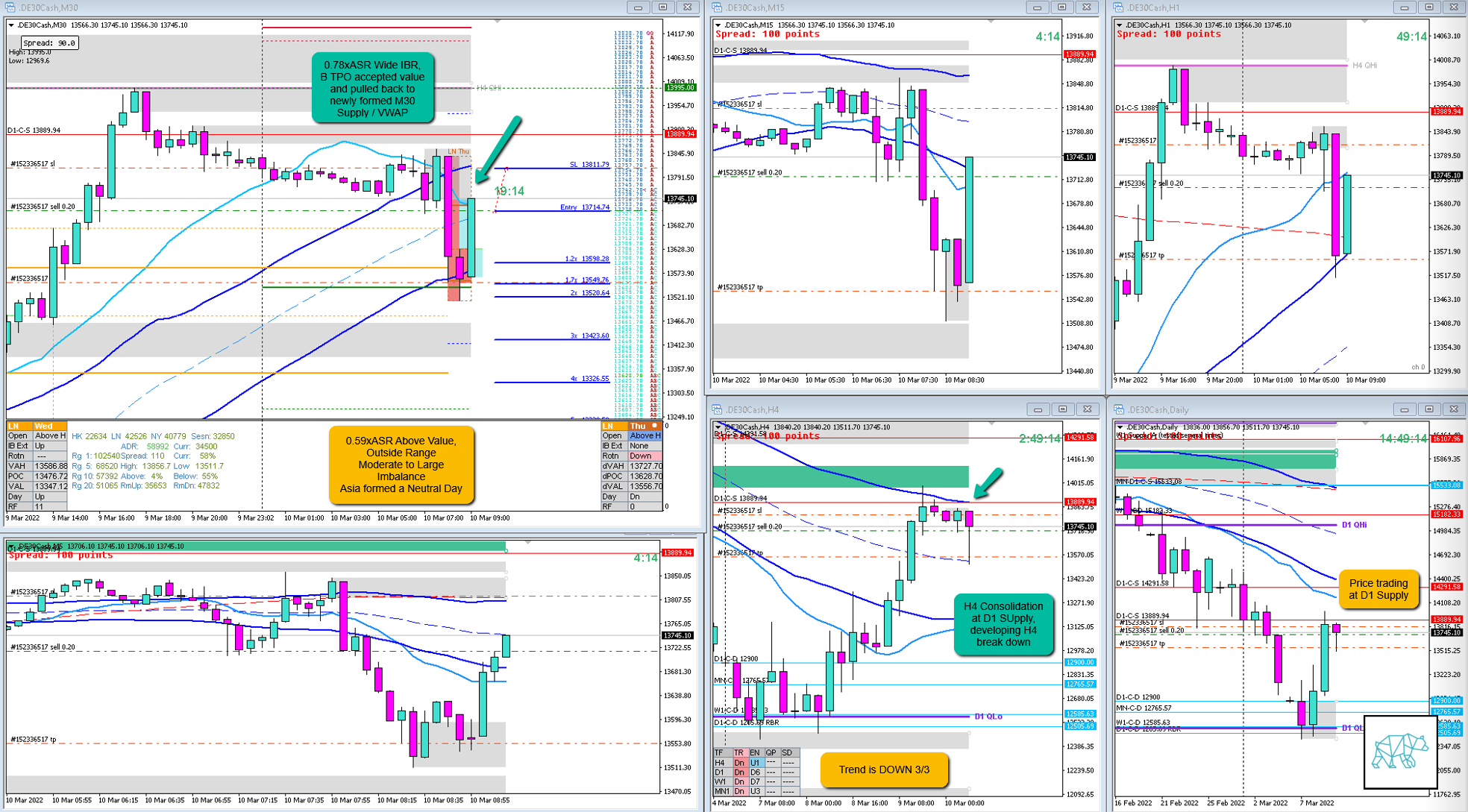

- Open Sentiment

- 0.59xASR Above Value, Outside Range

- Moderate to Large Imbalance

- Asia formed a Neutral Day

- IBR

- 0.78xASR Wide IBR

- Trend

- Strong DT 3/3

- H4: DOWN

- D1: DOWN

- W1: DOWN

- Hypo

- 2 & 3

- Hypo 2

- Short

- Late-Sustained Auction, monitor for Value acceptance

- Hypo 3

- Short

- Weakness From Within IBR

- Attempted Setup

- Weakness From Within IBR (Prior Extension)

- Entry Technique

- B TPO accepted value and C TPO started pulling back to newly formed M30 Bear Engulf, coinciding with M30 VWAP

- SL placement

- Standard SL (10000)

- TPO period for Entry

- C TPO

- Trade Duration

- 0h44m

- Long/Short

- Short

- Leading Narrative

- H4 consolidation at D1 Supply and developing break down

- Strong DT

- B TPO accepting value, price pulling back to newly formed LTF supply

Actual Development

- C TPO closed as a Bull Engulf but with long selling wick but I decided to take the trade off at 1R

- Price retraced to previous entry point another time before closing down and consequently alter on in the session continued lower

Good points

- Understanding the narrative and taking the trade

Bad Points

- The narrative hadn’t changed and I could’ve stuck with the trade. Although due to not having an extension I expected the responsive activity to potentially mess up the trade and did not want to risk it.

- When price pulled back to the same entry point during D TPO I considered going short again but didn’t due to the newly formed M30 Bull Engulf at VAH.

Next Day Analysis

- Target hit?

- No, 1R

- Time-based Exit?

- 2.9R

- Overlap Noise?

- 2.7R

- End of Day?

- 2.2R

- Highest R multiple?

- 3.8R

TAGS: Prior Extension, Above Value, Outside Range, Moderate to Large Imbalance, Trend is DOWN 3/3,

Premarket prep on the day:

Daily Report Card:

No Comments