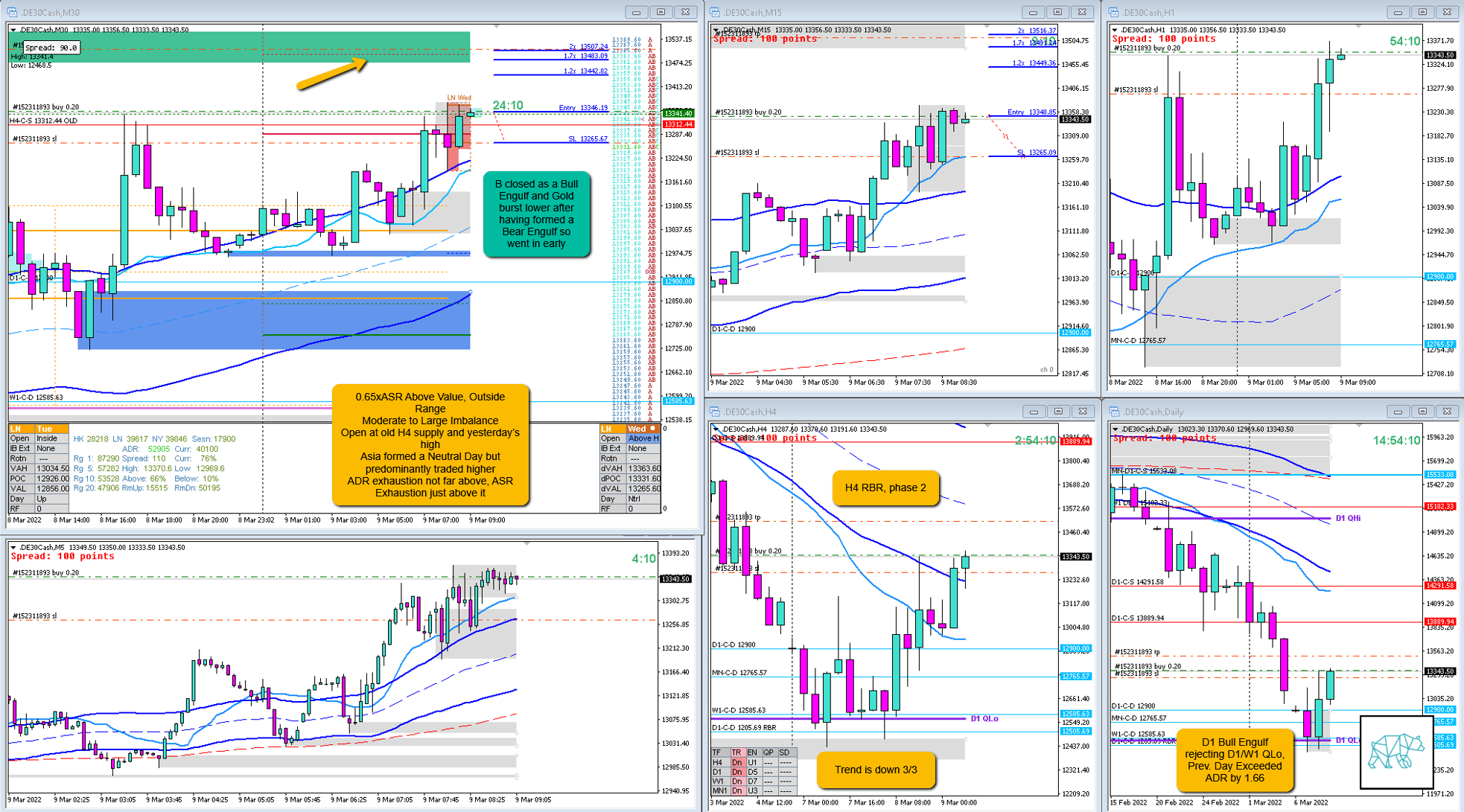

10 Mar 20220309 Trade Review DAX

Play: Sustained Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- 1.2R

- Open Sentiment

- 0.65xASR Above Value, Outside Range

- Moderate to Large Imbalance

- Open at old H4 supply and yesterday’s high

- Asia formed a Neutral Day but predominantly traded higher

- ADR exhaustion not far above, ASR Exhaustion just above it

- IBR

- 0.45xASR

- Trend

- Strong DT 3/3

- H4: DOWN

- D1: DOWN

- W1: DOWN

- Hypo

- 1

- Long

- Late-Sustained Auction, preferably close above Asia and IB / yesterday’s high

- Attempted Setup

- Early entry from within IB

- Entry Technique

- Gold had formed a Bear Engulf similarly to DAX forming a Bull Engulf during B TPO. C TPO was looking to do the same so I went long early before waiting for an extension.

- SL placement

- Short Session SL placement (8500)

- TPO period for Entry

- C TPO

- Trade Duration

- 0h26m

- Long/Short

- Long

- Leading Narrative

- D1 Bull Engulf rejecting D1/W1 QLo

- Open sentiment

- Gold burst lower, inverse correlation with DAX

Actual Development

- C extended and closed above IB in a sustained auction, D immediately extended higher and hit 1.2R target.

- The auction was sustained and hit 2R and eventually higher

Good points

- Taking the trade using early entry off inverse correlation with Gold

Bad Points

- Not necessarily bad but yet again I could’ve had a bigger R‑multiple using OODA loops

Next Day Analysis

- Target hit?

- Yes, 1.2R

- Time-based Exit?

- 0.8R

- Overlap Noise?

- 1.4R

- End of Day?

- 6R

- Highest R multiple?

- 8R

TAGS: Above Value, Outside Range, Moderate to Large Imbalance, Trend is DOWN 3/3,

Premarket prep on the day:

Daily Report Card

No Comments