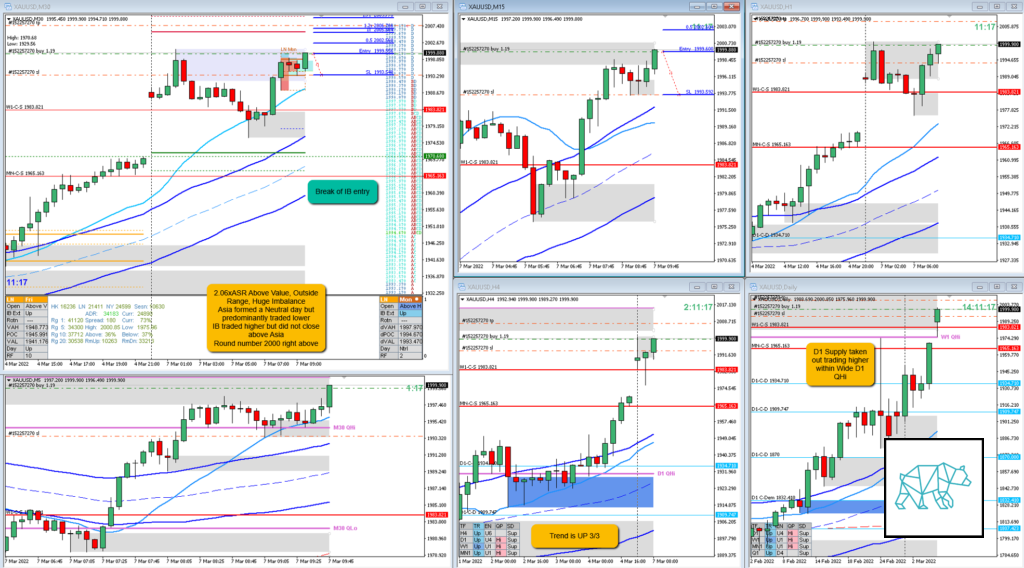

Play: Sustained Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #Gold #XAUUSD

- Result

- -0.3R

- Open Sentiment

- 2.06xASR Above Value, Outside Range, Huge Imbalance

- Asia formed a Neutral day but predominantly traded lower

- IB traded higher but did not close above Asia

- Round number 2000 right above

- IBR

- 0.64xASR Wide IBR

- Trend

- Trend is UP 3/3

- H4: UP

- D1: UP

- W1: UP

- Hypo

- 2

- Long

- Late-Sustained Auction, preferably close above Asia taking out LTF supply

- Attempted Setup

- Sustained Auction

- Entry Technique

- Break of IB

- SL placement

- Standard SL (600) although slightly bigger due to not having had a close value set in FX Synergy (adjusted this now)

- TPO period for Entry

- D TPO

- Trade Duration

- 0h10m

- Long/Short

- Long

- Leading Narrative

- Huge Imbalance

- Strong UT

- IB extension up

Actual Development

- Price started pulling back and trading within IBR before eventually closing higher in a supposed sustained auction before reversing (hard)

Good points

- No good points

Bad Points

- Taking the trade knowing price was trading into a big round number 2000 with a huge imbalance at the open

- Trading into W1/D1 QHi

- IBR had traded over 0.6xASR so is considered to be wide and evne less likely for a sustained auction

- Taking the trade off after realizing it was a bad trading idea. I considered putting this under good points. But since I did not adhere to my exit rules I decided to put it here.

Next Day Analysis

- Target hit?

- No, ‑0.3R

- Time-based Exit?

- -1R

- Overlap Noise?

- -1R

- End of Day?

- -1R

- Highest R multiple?

- 0.5R

TAGS: Wide IBR, Above Value, Outside Range, Huge Imbalance,

Premarket prep on the day:

Daily Report Card