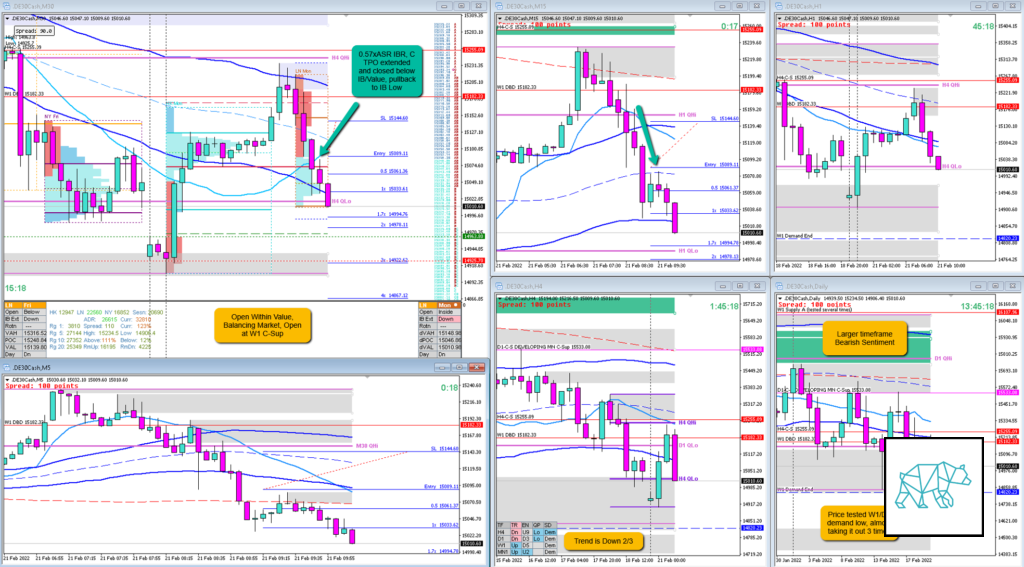

Play: Late-Sustained Auction, Value Rejection

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- 0R

- Open Sentiment

- Open Within Value

- Balancing Market

- Open at W1 C‑Sup

- IBR

- 0.57xASR

- Possible momentum

- Hypo

- 2

- Short

- Late-Sustained Auction

- Weakness From Within IBR

- Attempted Setup

- Late-Sustained Auction

- Entry Technique

- C closed below IBR & Value (technically rejecting value)

- D TPO pulls back to IB low before continuing lower

- Sell Limit Order at IB low

- SL placement

- Standard SL (55)

- TPO period for Entry

- D TPO

- Trade Duration

- Sell Limit Order did not get hit

- 2R would’ve hit in 1 hour

- Long/Short

- Short

- Leading Narrative

- Larger timeframe Bearish Sentiment

- Possible MN Phase 3

- W1 demand End tested multiple times

- Asia Gapped down, filled the gap trading higher

- London opened within value, extending and closing below IB and Value

- Larger timeframe Bearish Sentiment

Actual Development

- Price proceeded to close lower in a sustained auction taking out W1/D1 demand End

- Then a slight pullback before NY open before a continuation down

Good points

- Waiting for the pullback to IB low

Bad Points

- Being to rigid on a test of IB low — I should’ve just entered on a market order when price neared IB low. A few pips don’t matter.

Next Day Analysis

- Target hit?

- No, order did not get triggered

- Time-based Exit?

- 2.2R

- Overlap Noise?

- 3.1R

- End of Day?

- 13R

- Highest R multiple?

- 13R

TAGS: Open Within Value, Balancing Market, Trend is Down 2/3,

Premarket prep on the day: