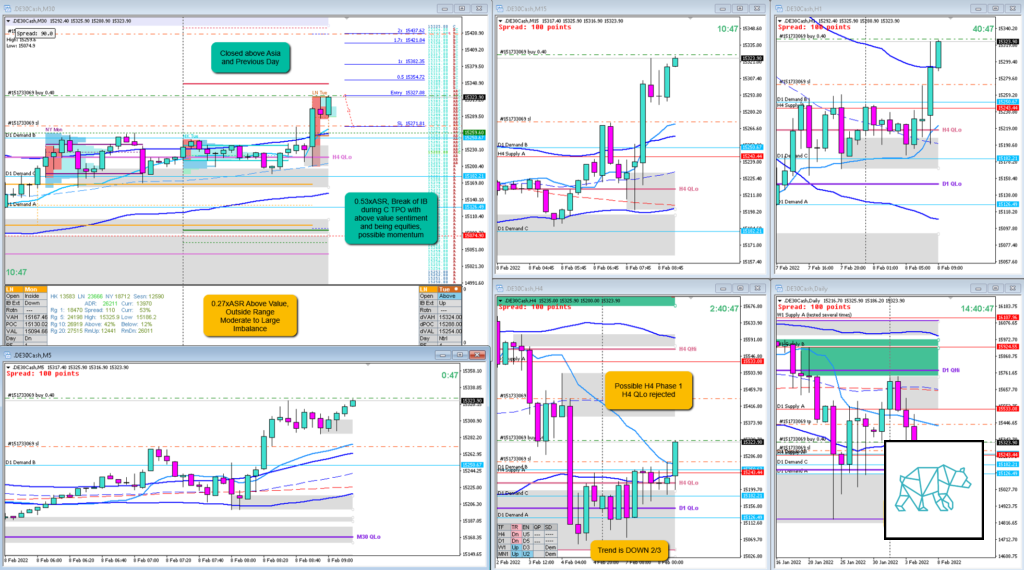

Play: Sustained Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- -1R

- Open Sentiment

- 0.27xASR Above Value, Outside Range

- Moderate to Large Imbalance

- IBR

- 0.53xASR

- Hypo

- 2

- Late-Sustained Auction

- Attempted Setup

- Sustained Auction

- Entry Technique

- Break of IB

- SL placement

- Average SL (5500)

- TPO period for Entry

- C TPO

- Trade Duration

- 0h42m

- Long/Short

- Long

- Leading Narrative

- Price rejected H4 QLo

- Price trading at D1 QLo (although weakly rejected)

- Possible H4 Phase 1

- Price broke H4 supply during IBR

- Price closed above Asia and previous day high

Actual Development

- C closed as a RBR but right at IB high

- D TPO reversed and failed the auction closing as a Bear Engulf

Pros for the trade

- Price having rejected H4 QLo

- Possible H4 Phase 1

- Price trading at D1 QLo and somewhat weakly rejected it

- Price broke and close dabove Asia and previous day

- Open above value sentiment, although outside range still a moderate to large imbalance

Cons for the trade

- Trend was down 2/3

- Possible Larger timeframe bearish sentiment

Good points

- Taking the trade

- Letting Stop get hit even though I saw M15 Closing as a Bear Engulf within IB (can possible track for future early exit management but for now I continue letting stops do its things)

- Right on direction on the day

Bad Points

- Jumped the gun on the trade. Hypo 2 was late-sustained auction entry and I entered on break of IB. FOMO.

- Not taking the Failed Auction trade on the reversal If I had followed my plan I might have gone with the Failed Auction short trade as per Hypo 3.

Next Day Analysis

- Stop hit?

- Yes, ‑1R

- Time-based Exit?

- -1R

- Overlap Noise?

- -1R

- End of Day?

- -1R

- Highest R multiple?

- 0.3R

TAGS: Above Value, Outside Range, Moderate to Large Imbalance, Trend is Down 2/3,

Premarket prep on the day: