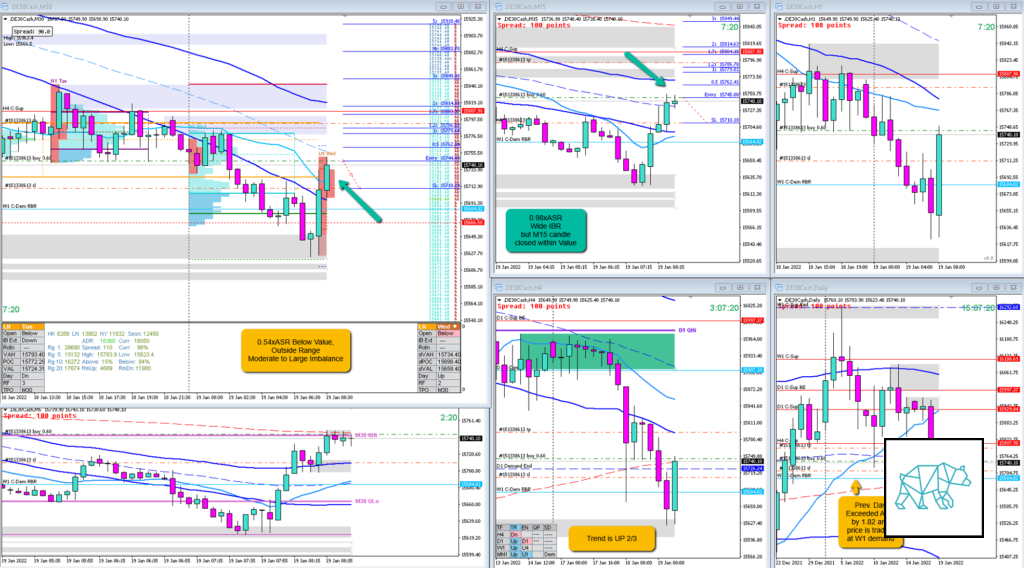

Play: Value Acceptance

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- 1.2R

- Product

- DAX

- Open Sentiment

- 0.54xASR Below Value, Outside Range

- Moderate to Large Imbalance

- IBR

- 0.98xASR

- Wide IBR

- Hypo

- Hypo 1

- Long

- Value Acceptance, monitor for continuation although H4 c‑sup above VAH

- Attempted Setup

- Value Acceptance

- Entry Technique

- M15 candle close within Value

- SL placement

- Standard size (35), sadly cutting through the body of the entry candle but due to expecting momentum this can be forgiven

- TPO period for Entry

- B TPO

- Trade Duration

- 0h54m

- Long/Short

- Long

- Leading Narrative

- Prev. Day Exceeded ADR by 1.82

- Price trading at W1 demand and started reacting

- M15 candle during B TPO closed within Value in an 2/3 uptrend

Actual Development

- B TPO closed within value followed by a RBR hitting 1.2R

Good points

- Taking the trade even though having supply at VAH and wide IBR

Bad Points

- Could’ve let the trade go on longer but due to the time of year I decided to stick with the 1.2R rule for now

Next Day Analysis

- Price ended up developing a very big H4 Bull ENgulf during the LN session then pulled back at the end of the day forming a Neutral near-Doji signaling a possible continuation unless the next day closes higher.

- Target hit?

- Yes, 1.2R

- Time-based Exit?

- 2.9R

- Overlap Noise?

- 2.5R

- End of Day?

- 0.7R

- Highest R multiple?

- 4.5R

TAGS: Below Value, Outside Range, Trend is UP 2/3, Moderate to Large imbalance, Prev. Day Exceeded ADR,

Premarket prep on the day: