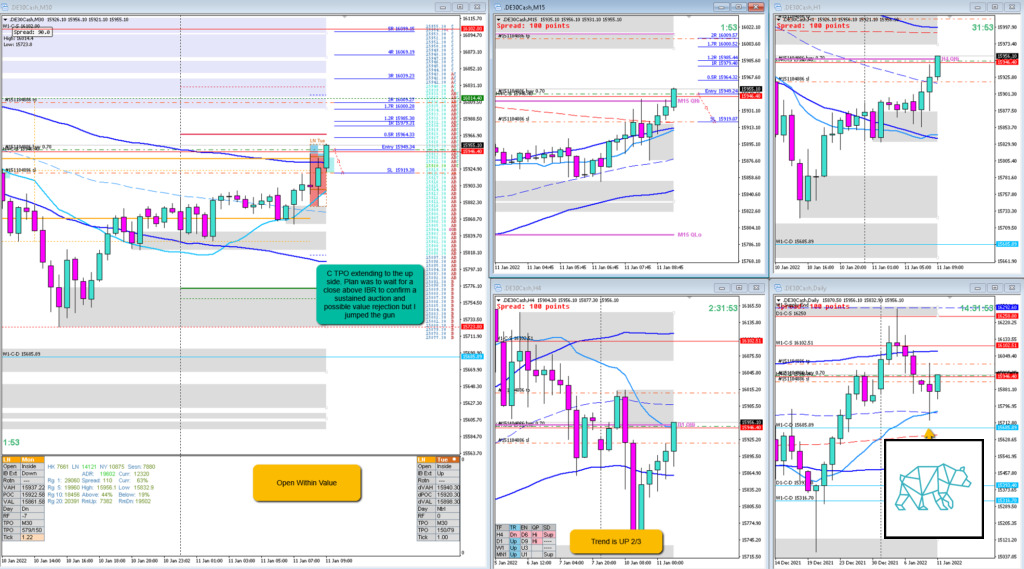

Play: Late-Sustained Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- 1R

- Product

- DAX

- Open Sentiment

- Open Within Value

- IBR

- 0.48xASR

- Hypo

- Hypo 2

- Long

- Late-sustained auction entry

- Risky, price trading right into H4 supply, price would need to extend higher and hold above IB preferably taking out LTF supply

- Attempted Setup

- Late-sustained auction

- Entry Technique

- Break of IB with C extending quite a bit above IB, pullback to IB high

- SL placement

- ASR Short SL 30 pips

- TPO period for Entry

- C TPO

- Trade Duration

- 0h09m

- Long/Short

- Long

- Leading Narrative

- Values in DT, open within value, trend is up 2/3,

- B TPO closing above Asia

- Momentum extension in C TPO

Actual Development

- C TPO closed above IB

- D extended and closed higher reaching 1R and I closed the trade

Good points

- Taking the trade although it was not a great trading idea. I might have been right on the general direction of the day this was not the way to go long. A strength from within IBR would’ve been the way to go.

Bad Points

- this was a BAD TRADING IDEA

- I DID NOT WAIT for C TPO to close above IBR to confirm a possible rejection before entering. I entered 2 minutes before close of C TPO.

- Trading right into H4 supply as well as ASR 0.5 high not providing much of a profit target. The actual play would’ve been the reversal at ASR 0.5 high

- Trading right into D1 QHi

Next Day Analysis

- Target hit?

- No, but I still took 1R

- Time-based Exit?

- -1R

- Overlap Noise?

- -1R

- End of Day?

- -1R

- Highest R multiple?

- 1R

TAGS: Open Within Value, Bad Trading Idea,

Premarket prep on the day: