15 Nov 20211115 Premarket Prep DAX

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #index #indices #DAX #DE30Cash

This is my premarket prep for today’s European session for DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Compared against Weekly Trading Plan

- Price trading within last week’s body

Non-conjecture observations of the market

- Price action

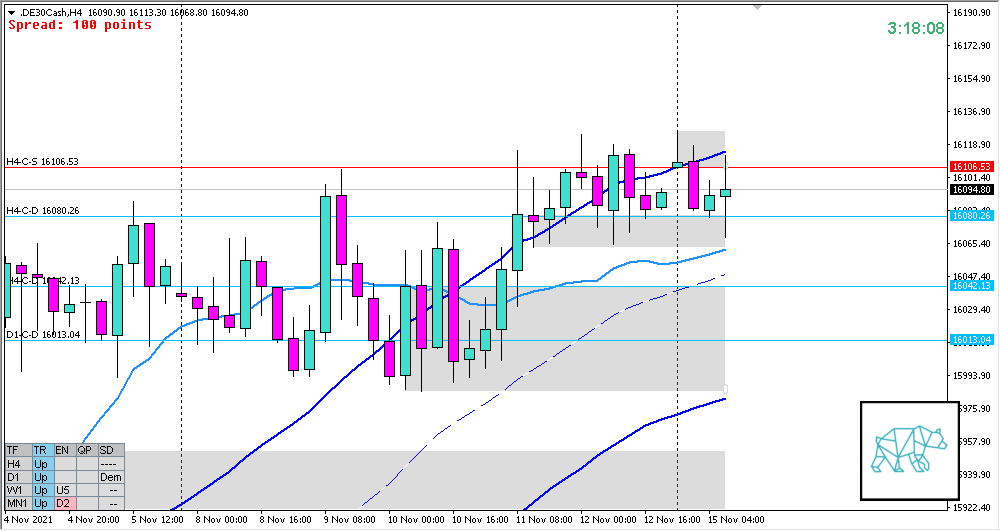

- Some D1 Consolidation after Bull Engulf was formed giving D1-C‑D 16013.04

- H4 Bear Engulf giving H4-C‑S 16106.53 followed by an Inside Bar at H4-C‑D 16080.26 OLD

- Trend: H4 Up, D1 Up, W1 Up

- Prevailing trend: Trend is UP 3/3

- Market Profile

- 2 overlapping value at the top of the range

- Daily Range

- ADR: 8517

- ASR: 8086

- 2022

- ASR Short: 7236

- 1809

- Day

- Yesterday’s High 16126.30

- Yesterday’s Low 16064.39

Sentiment

- LN open

- Below Value, Within Range

- Open distance to value

- 0.04xASR

- Narrative

- Moderate Imbalance although possibly a bit ambiguous due to the very near proximity to VAL. IBR already rotated through value. Possible developing H4 DBD although price is trading between H4 supply and demand. Possible H4 Phase 1 / 3. Asia extended down if LN does the same ADR exhaustion implication changes with that.

- Clarity (1–5, 5 being best)

- 3

- Hypo 1

- Value Acceptance, possible sustained auction up

- Hypo 2

- Failed Auction Long

- Hypo 3

- Sustained Auction Short

- Hypo 4

- Auction Fade Long, variation to Hypo 3

Additional notes

- N.A.

ZOIs for Possible Shorts

- Not favored in equities

- H4-C‑S 16106.53

ZOIs for Possible Long

- H4-C‑D 16080.26

- H4-C‑D 16042.13 OLD

Mindful Trading (lack of sleep?)

- Feeling Okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 20 trades by the end of the month, preferably 2 a day (not in the same product at the same time)

- No early exits, either hit SL or 2R target

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- Process

- Keep trade review comments short

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING

No Comments