#fintwit #orderflow #daytrading #premarketprep #XAUUSD #GOLD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

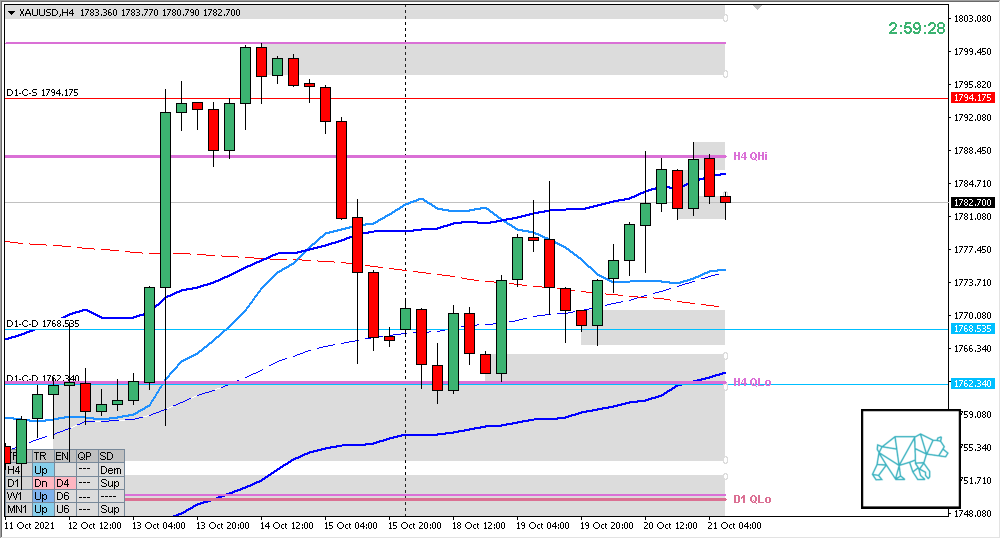

Compared against Weekly Trading Plan

- Price trading above last week’s body but still within range

Non-conjecture observations of the market

- Price action

- Follow-through on D1 Bull Engulf with long selling wick making a HH traversing 1xADR

- H4 Phase 2 arriving at H4 QHi (longs might prove risky)

- Trend: H4 Up, D1 Down, W1 Up

- Prevailing trend: MIXED Trend

- Market Profile

- 3‑day bracket

- Daily Range

- ADR: 21334

- ASR: 14996

- 375

- ASR Short: 7700

- 193

- Day

- Yesterday’s High 1788.340

- Yesterday’s Low 1766.760

Sentiment

- LN open

- Above Value, Within Range

- Open distance to value

- 0.12xASR

- Narrative

- Moderate Imbalance. Close proximity to VAH. IBR quite tight at 0.2xASR. Price trading at H4 QHi.

- Clarity (1–5, 5 being best)

- 2

- Hypo 1

- Value Edge Reversal

- Hypo 2

- Value Acceptance

- Hypo 3

- Sustained Auction Up

- Hypo 4

- Auction Fade Short

Additional notes

- N.A.

ZOIs for Possible Shorts

- D1-C‑S 1794.175

ZOIs for Possible Long

- D1-C‑D 1768.535

- D1-C‑D 1762.340

Mindful Trading (lack of sleep?)

- Dealing with personal stuff. Might be distracted.

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 20 trades by the end of the month, preferably 2 a day (not in the same product at the same time)

- No early exits, either hit SL or 2R target

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- Process

- Keep trade review comments short

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING