29 Sep 20210928 Trade Review DAX

Play: Weakness From Within IBR

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- 2R

- Product

- DAX

- Open Sentiment

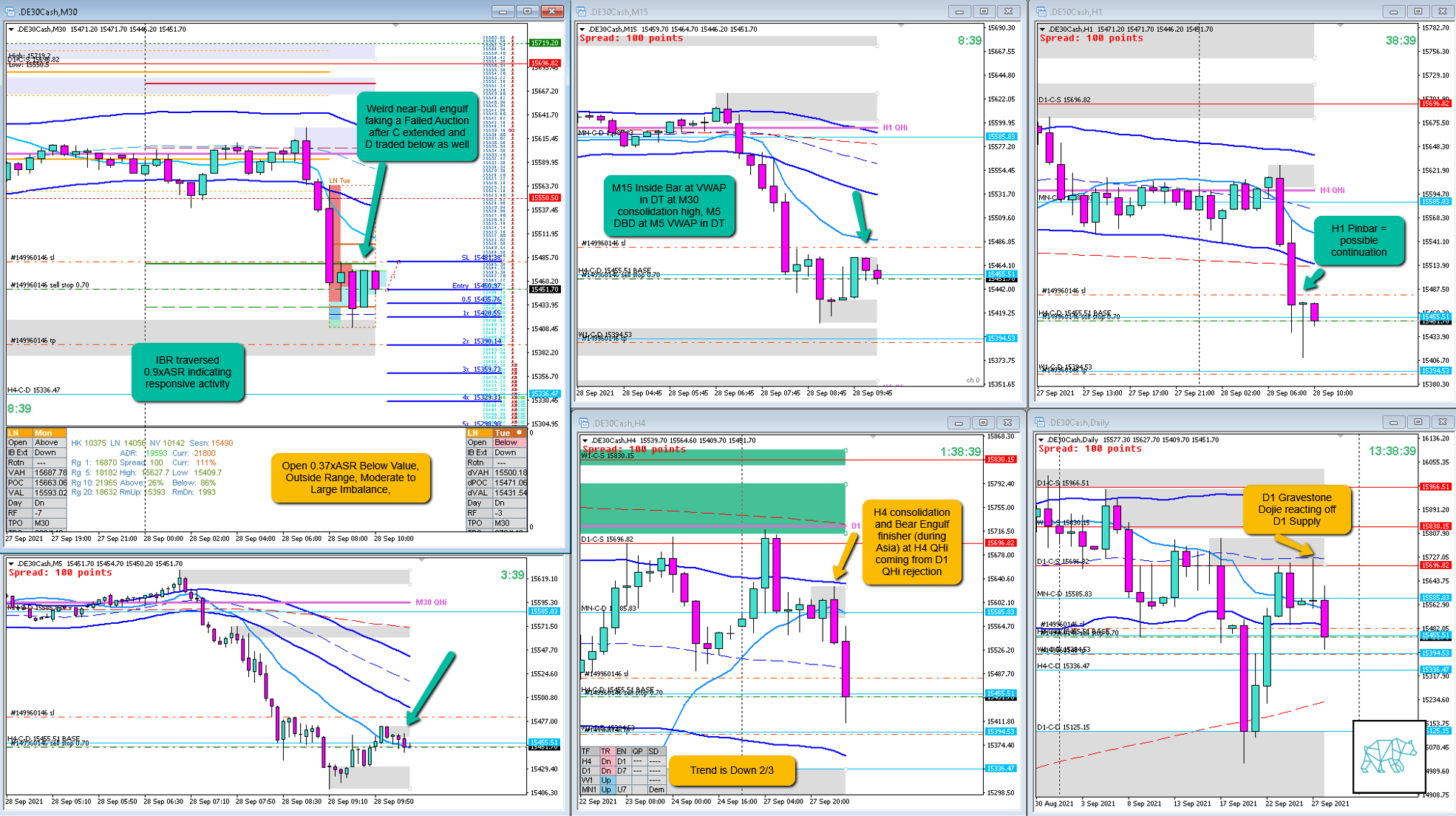

- Open 0.37xASR Below Value, Outside Range, Moderate to Large Imbalance,

- IBR

- 0.9xASR

- Hypo

- 3

- Weakness from Within IBR, variation to Hypo 1 or 2 in line with a possible continuation to H4 Bear Engulf

- Attempted Setup

- Weakness From Within IBR

- Entry Technique

- M15 Inside Bar at M30 consolidation high, M5 DBD at M5 VWAP in DT

- SL placement

- 30 pips. Slightly tighter than standard SL (35) but it was placed above the structure. This was good.

- TPO period for Entry

- E TPO

- Trade Duration

- 45 minutes

- Long/Short

- Short

- Leading Narrative

- Asia closed down forming a H4 Bear Engulf after the previous day closed as a D1 Gravestone Doji. Possibility for a unidirectional day. IB opened moderate to large imbalance and traversed down taking out demand. Then C TPO extended and closed below IB exhausting ADR. Even with the wide IBR the best opportunity here is for a continuation with the move. Due to the wide IBR a sustained auction is not the best play. Thus weakness from within IBR can be an entry to go with the open sentiment. Trend was also Down 2/3.

Actual Development

M15 meandered a little bit but still closing down and forming a M30 Three Inside Down. Price slowed down at LTF demand (as well as W1 demand) before continuing and hitting my 2R target.

Good points

- That I spotted the narrative

- That I executed based on Price action weakness from within IBR along with the open sentiment.

Bad Points

- Due to the narrative and open sentiment I could have had Hypo 3 Weakness from within IBR as hypo 1 and Hypo 4 Sustained Auction Down as my hypo 2.

Next Day Analysis

- Target hit?

- Yes, 2R

- Time-based Exit?

- 2.2R

- Overlap Noise?

- 2.5R

- End of Day?

- 6.1R

- Highest R multiple?

- 7.4R

TAGS: Below Value, Outside Range, Moderate to Large Imbalance,

Premarket prep on the day:

No Comments