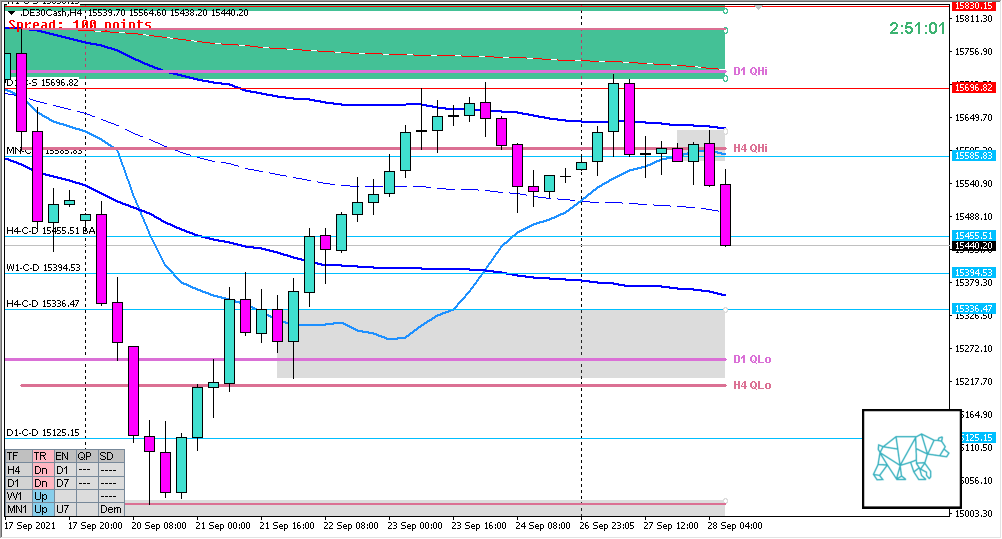

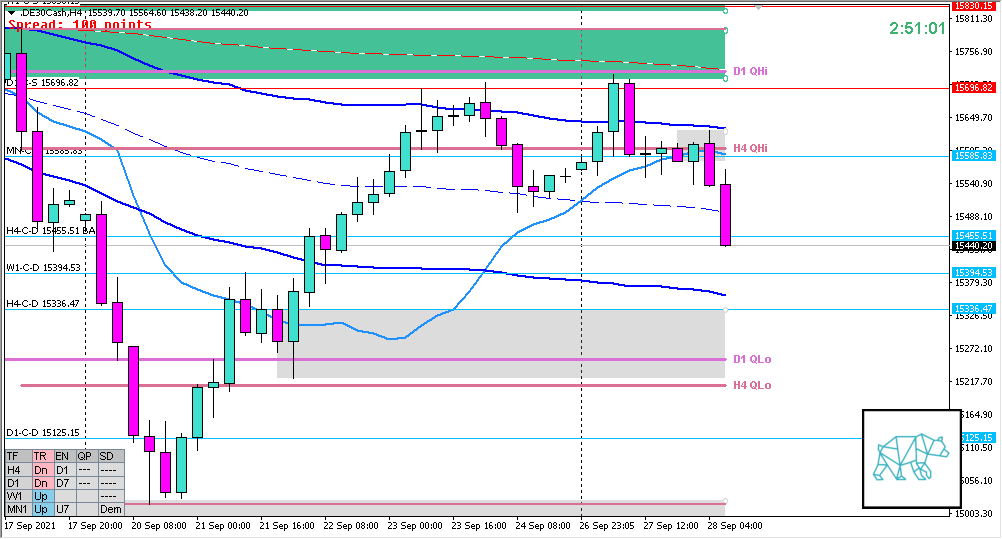

28 Sep 20210928 Premarket Prep DAX

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #index #indices #DAX #DE30Cash

This is my premarket prep for today’s European session for DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Compared against Weekly Trading Plan

- Price is trading above last week’s body and has made a HH

Non-conjecture observations of the market

- Price action

- D1 tested D1-C‑S 15696.82 and closed as a Gravestone Doji

- H4 Bear Engulf with no continuation, instead some consolidation above MN/W1 demand

- Trend: H4 Down, D1 Down, W1 Up

- Prevailing trend: Trend is Down 2/3

- Market Profile

- Value created above the previous with currently price trading below

- Daily Range

- ADR: 19593

- ASR: 14056

- 3500

- Day

- Yesterday’s High 15719.20

- Yesterday’s Low 15550.50

Sentiment

- LN open

- Below Value, Outside Range

- Open distance to value

- 0.37xASR

- Narrative

- Moderate to Large Imbalance. IBR traversed 0.9xASR indicating possible responsive activity. Price returned to H4-C‑D 15455.51 BASE level which could signal a continuation. Trend is Down 2/3. Premarket closed as a H4 Bear Engulf at H4 QHi.

- Clarity (1–5, 5 being best)

- 4

- Hypo 1

- Failed Auction Long

- Hypo 2

- Strength from within IBR

- Hypo 3

- Weakness from Within IBR, variation to Hypo 1 or 2 in line with a possible continuation to H4 Bear Engulf

- Hypo 4

- Sustained Auction Down, risky due to wide IBR, late-sustained auction preferred

Additional notes

- N.A.

ZOIs for Possible Shorts

- Not favored in equities

- D1-C‑S 15696.82

ZOIs for Possible Long

- H4-C‑D 15455.51 Base

- W1-C‑D 15394.53

Mindful Trading (lack of sleep?)

- Might be coming down with something. Will take it easy.

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 20 trades by the end of the month, preferably 2 a day (not in the same product at the same time)

- Weekly Goal

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- No early exits, either hit SL or 2R target

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING

No Comments