14 Sep 20210913 Trade Review DAX

Play: Strength From Within IBR

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

Market Narrative

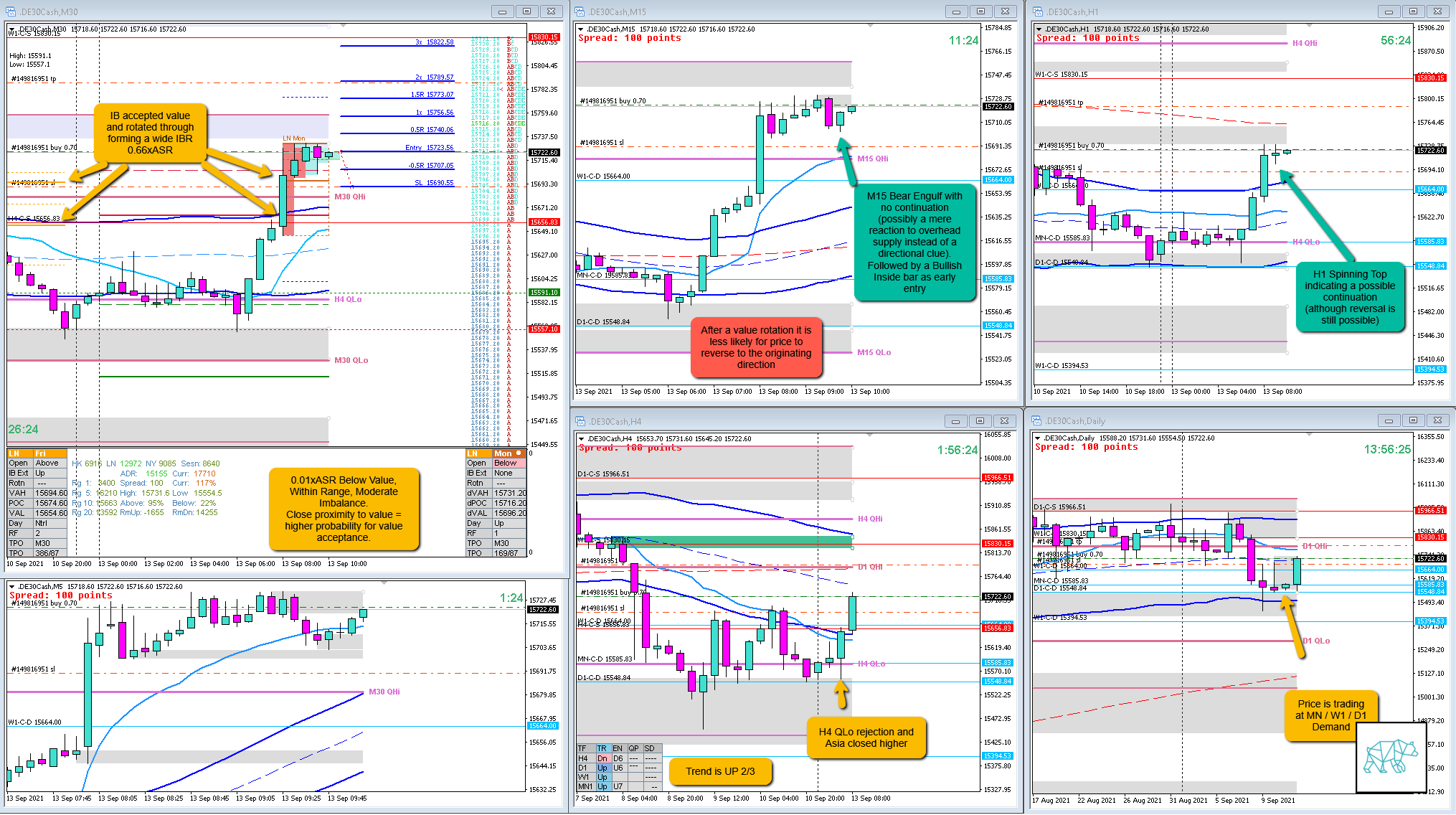

Price slowdown on D1 when arriving at larger timeframe demand. Asia had traded higher after a H4 QLo rejection. Trend was up 2/3. Close proximity to value edge with 0.01xASR below value, within range indicates a moderate imbalance and higher probability of a value acceptance. This acceptance came during IB. IBR was 0.66xASR wide indicating a higher probability for a move back into IBR if there was a probe outside of it ie. IB extension. However, due to price having rotated through value and was consolidating above VAH (plus DAX being equities) I decided the more probable play would be a strength from within IBR long. Then monitor for a sustained auction which came later in the session.

What hypo was it?

Hypo 4

Strength from within IBR

Due to the wide IBR I could have put this higher in my ranking of the hypos. At least I included it and most of all I executed on it.

How was the Entry?

The Entry was good although I was stalking a better entry to be honest. When price hit the M5 demand I was thinking to just go long. Then I thought let’s see if there’s a reaction first. When the bull engulf came it was quite weak. The following M5 was a soji with slightly longer selling wick so I waited for a RBR to complete before entering. This was okay as I was still within my area that allowed for good SL placement.

How was the SL placement and sizing?

I used a standard sized SL and this was okay.

How was the profit target?

ASR exhaustion was at 1.5R but I expected price to move through it a bit more hitting 2R before possibly reversing as I have seen that happen many times.

How was the Exit?

I took the trade off at 2R maybe a few pips too early but hey fuck it. Price eventually started reversing so I am happy with my decision.

What would a price action-based exit have done for the trade?

1.5R

What would a time-based exit have done for the trade?

1.6R, 1.5R in overlap noise. End of Day would have taken out my SL ‑1R.

What did I do well?

I did well to understand the narrative and let it overrule the wide IBR implication and go long anyway instead of waiting for a failed auction.

What could I have done better?

I am very happy with this trade. I monitored for a continued validation of my thesis. When E extended one pip above IB I thought okay not the strongest but at least they’re trying to take it higher. Then in G price finally made its move.

Observations

A rotation through value has a continuation bias instead of a reversal.

Missed Opportunity

N.A.

TAGS: Below Value, Within Range, Moderate Imbalance,

Premarket prep on the day

Daily Report Card on the day

No Comments