11 Sep 20210909 Missed Trade Gold

Play: Sustained Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #Gold #XAUUSD #missedtrade

These are trades I could have taken but for some reason I did not. This could be due to me not paying attention or simply not feeling like trading. This is usually the case when I am not in the right state of mind due to lack of sleep, personal issues, etc.

Reason for missing the trade (explain the narrative)

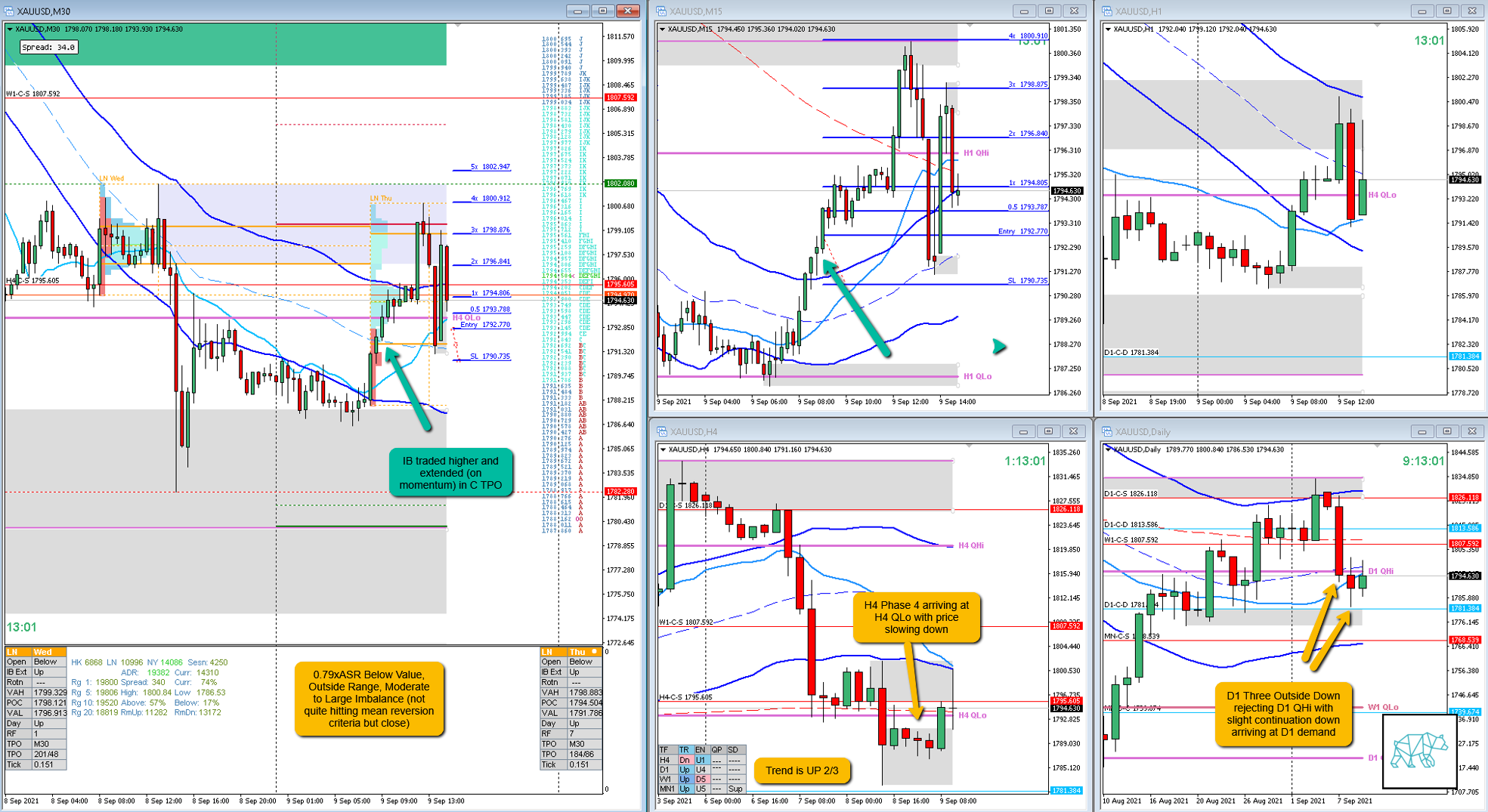

There was a D1 Three Outside Down rejecting D1 QHi with a slight continuation. The market opened 0.79xASR Below Value, Outside Range, Moderate to Large imbalance, IB then traded up and extended on momentum in C TPO as per a mean reversion. Even though mean reversion wasn’t quite hit at the open there was still more of a probabilistic bias towards a move towards value edge.

The reason I missed it was I couldn’t fit a good profit target to value edge. I calculated my SL should be about 30 pips but now I know I could’ve used a tighter stop. The reason for this being is that instead of taking the complete Average Session Range I should’ve taken note of the range from open till noon. This would have been below the 100 pip barrier that allows for tighter stops. This is a new ‘concept’ to me and therefore I did not apply this rule to this setup. I was indeed stalking this trade but yeah… subpar profit target I thought so let it go.

What hypo was it?

Hypo 3

Sustained Auction Long

Based on the narrative I preferred other plays over this one but this was the play during the session. All good here.

What would have been the Entry?

Trade 1

DTTZ: 1st DTTZ

Entry Method: IB Break Entry

How was the SL placement and sizing?

Trade 1

SL placement: 20 pips to calculate for the tighter range and profit target to value edge.

How was the profit target?

Trade 1

Profit target: 2R at VAL and this was hit

What would a price action-based exit have done for the trade?

Trade 1

Exit:

What would a time-based exit have done for the trade?

Trade 1

Exit:

TAGS: Below Value, Outside Range, Moderate to Large imbalance,

Extra Observations

Mean reversion criteria doesn’t necessarily have to be hit at the open to warrant a move to value edge.

Premarket prep on the day

Daily Report Card on the day

No Comments