08 Sep 20210907 Trade Review DAX

Play: Sustained Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

Market Narrative

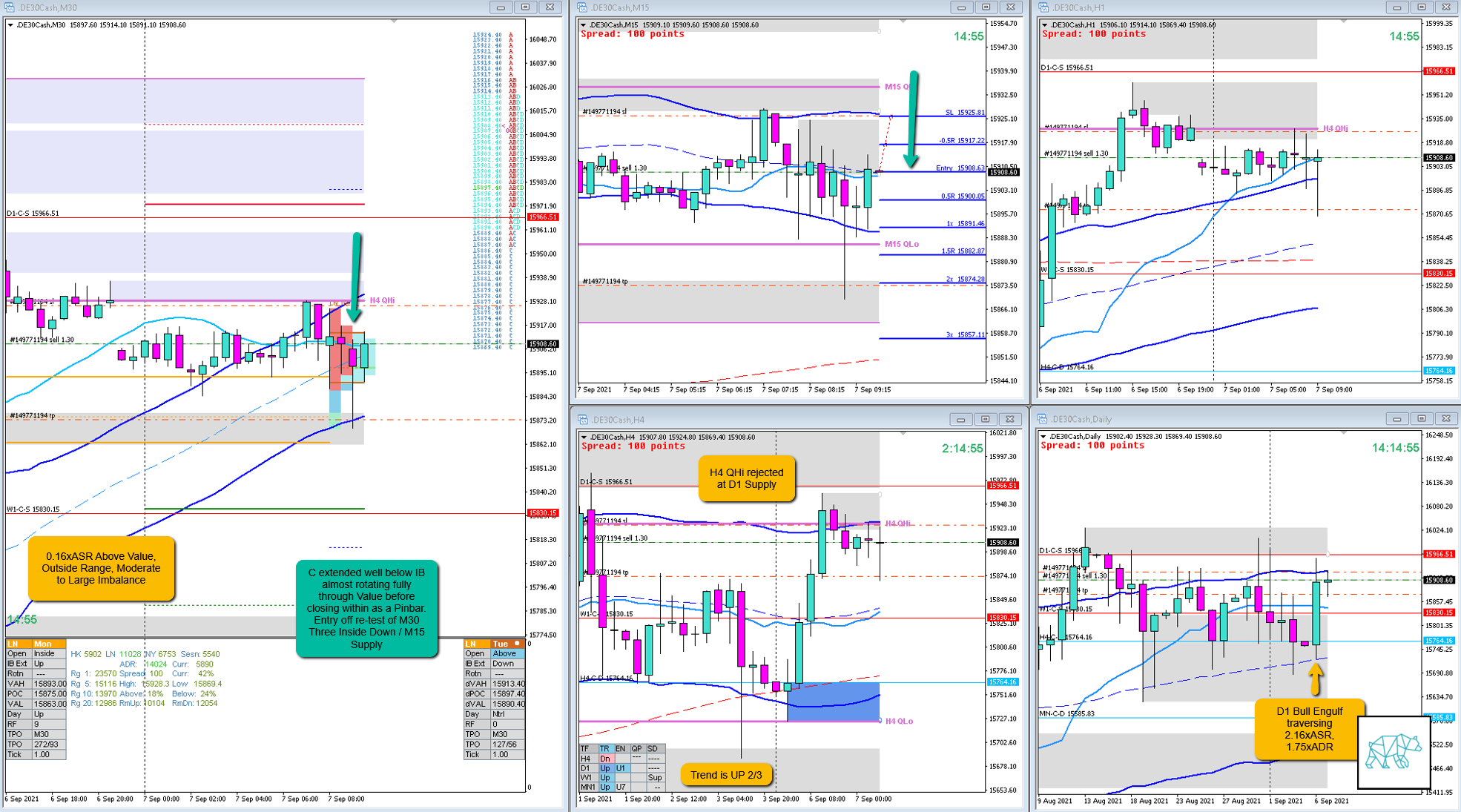

There was an open of 0.16xASR Above Value, Outside Range, Moderate to Large Imbalance. The day prior was a huge bull engulf exceeding ADR quite a bit by 1.75x. Expectancy is a retracement of that move. When market opened in close proximity to value edge a value acceptance is possible. Although that’s not the entry criteria for today’s play. The entry criteria is the D1 Bull Engulf exceeding ADR narrative so a sustained auction down is expected. Thus there is no need for price to accept value first before entering. Along these lines I waited for a pullback to M15 Supply to go Short. There is also still a D1 Phase 1 / 3 going on.

What hypo was it?

Hypo 1

VAA, Sustained Auction Down, preferred late-sustained auction entry

Hypo was good. I normally wait for price to accept value but understanding the D1 narrative I waited for a pullback to get a better entry and R multiple.

How was the Entry?

Entry was good. Not letting price action fool me to think value is just getting probed and there might be a reversal instead. IBR was quite tight and price had extended quite a bit to the downside almost fully rotating through value.

How was the SL placement and sizing?

A bit too tight. I placed a 1750 SL but I should’ve used a 2000 SL. My thinking was to place it above IB in the case that IB gets extended to the upside it would’ve invalidated my thesis and thus it would’ve been valid to get taken out there. In hindsight I realized that it was slightly too tight. 1) because it was less than the minimum of 20 pips and 2) because my SL would have gotten hit due to the spread difference in shorts without having extended the IB to the upside.

Nonetheless it was this slightly tighter SL that caused me to reach a 2R target within the trading session. If not for this the trade would’ve retraced to my entry point for 2.5 hours before reaching 4.2R at the end of NY (latest cut off under current trading rules).

How was the profit target?

Profit target was good as the entry was great and 2R would have not even needed a LL compared to the extension in C.

How was the Exit?

2R target reached in F.

What would a price action-based exit have done for the trade?

0.9R at the close of G closing as a Bullish Inside Bar but because it was still within value I would not have taken the trade off. But as it technically failed the auction that could’ve been a PA-based exit.

What would a time-based exit have done for the trade?

0.8R at normal cut off, 0.1R at Overlap noise cut off. End of Day cut off 4.2R.

What did I do well?

I did well to understand the D1 narrative and let it overrule the value acceptance narrative and go for a sustained auction down play.

What could I have done better?

I could’ve had a better SL placement but then I would’ve seen the trade go against me which is okay. It still hit my target later on the day. Even went to 4.2R at the end of the day.

Observations

Prev. Day Exceeded ADR reversals.

Missed Opportunity

N.A.

TAGS: Above Value, Outside Range, Moderate to Large Imbalance, Prev. Day Exceeded ADR, Trend is UP 2/3,

Premarket prep on the day

Daily Report Card on the day

No Comments