27 Aug 20210826 Missed Trade DAX

Play: Failed Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash #missedtrade

These are trades I could have taken but for some reason I did not. This could be due to me not paying attention or simply not feeling like trading. This is usually the case when I am not in the right state of mind due to lack of sleep, personal issues, etc.

Reason for missing the trade (explain the narrative)

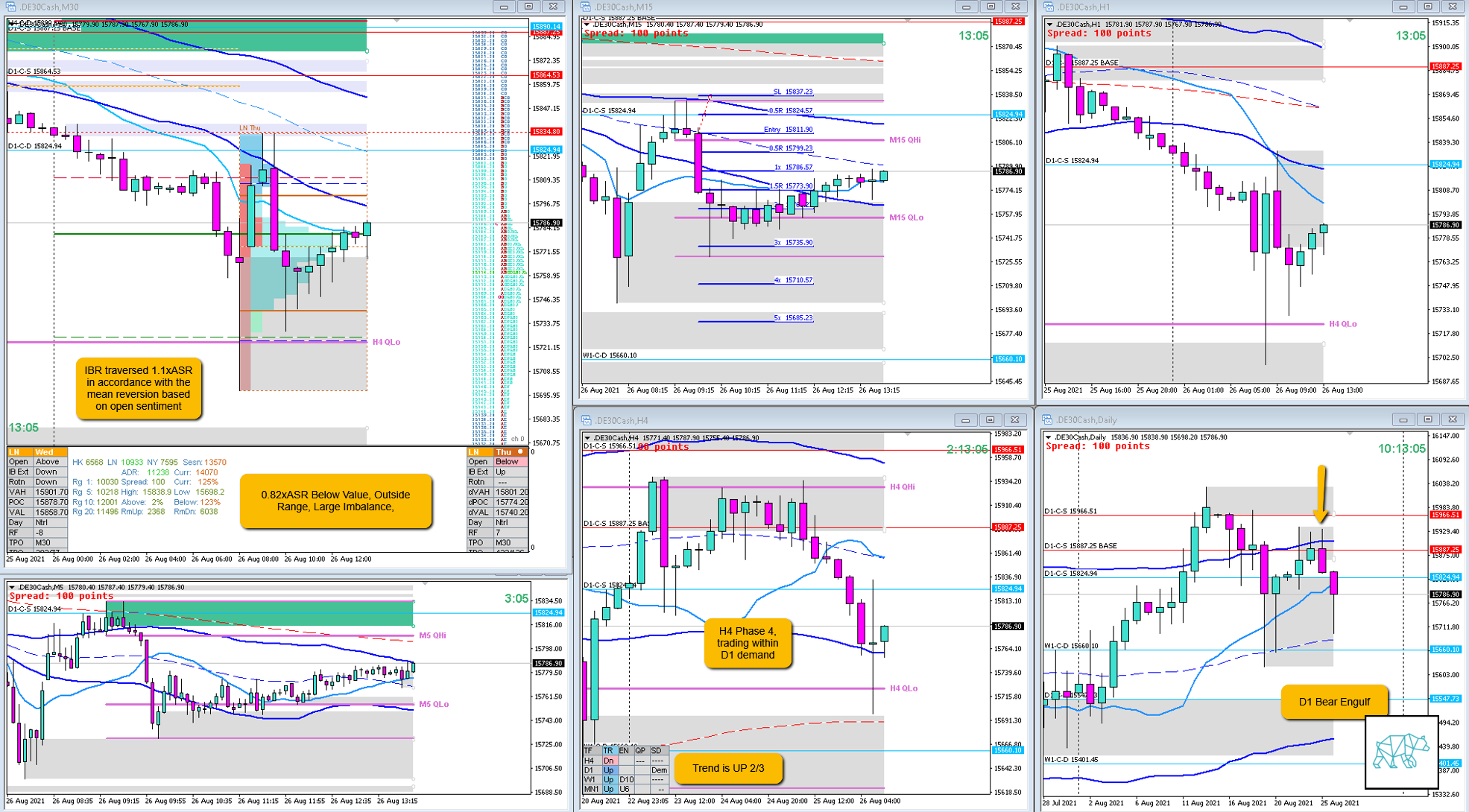

There was an open 0.82xASR Below Value, Outside Range, Large Imbalance, indicating a possible mean reversion. This already came at the open as IBR traversed 1.1xASR. This wide of IBR is indicative of responsive activity and any sustained auction are bound to fail. Thus Failed Auctions or strength/weakness from within IBR are favored.

I didn’t take the trade as I hesitated contemplating the importance of the M30 Inverted Hammer extendeding over IB in C then D forming a Poor High. In my experience these Poor High/Lows get taken out. I have now reaffirmed that this is most likely the case in a sustained auction. Not when expecting responsive activity like we were on this day.

What hypo was it?

Hypo 3

Failed Auction Short, risky due to trading at D1 demand and open sentiment

On the money. C extended above as well D but then closed as a M15 Bear Engul with long selling wick failing the auction.

What would have been the Entry?

Trade 1

DTTZ: 1st

Entry Method: M15 Bear Engulf with long selling wick after a slight consolidation preceded it.

How was the SL placement and sizing?

Trade 1

SL placement: Slightly tighter than standard right above the M15 wicks would have been great

How was the profit target?

Trade 1

Profit target: Due to the wide IBR a target of IB low in this case would not have been realistic. 3R was easily hit although 2R would’’ve been enough.

What would a price action-based exit have done for the trade?

Trade 1

Exit: 2R

What would a time-based exit have done for the trade?

Trade 1

Exit: 2R

TAGS: Below Value, Outside Range, Large Imbalance,

Extra Observations

Poor Highs/Lows lose their edge on responsive days.

Premarket prep on the day

No Comments