26 Aug 20210824 Trade Review DAX

Play: Return to Value, Reversal

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

Market Narrative

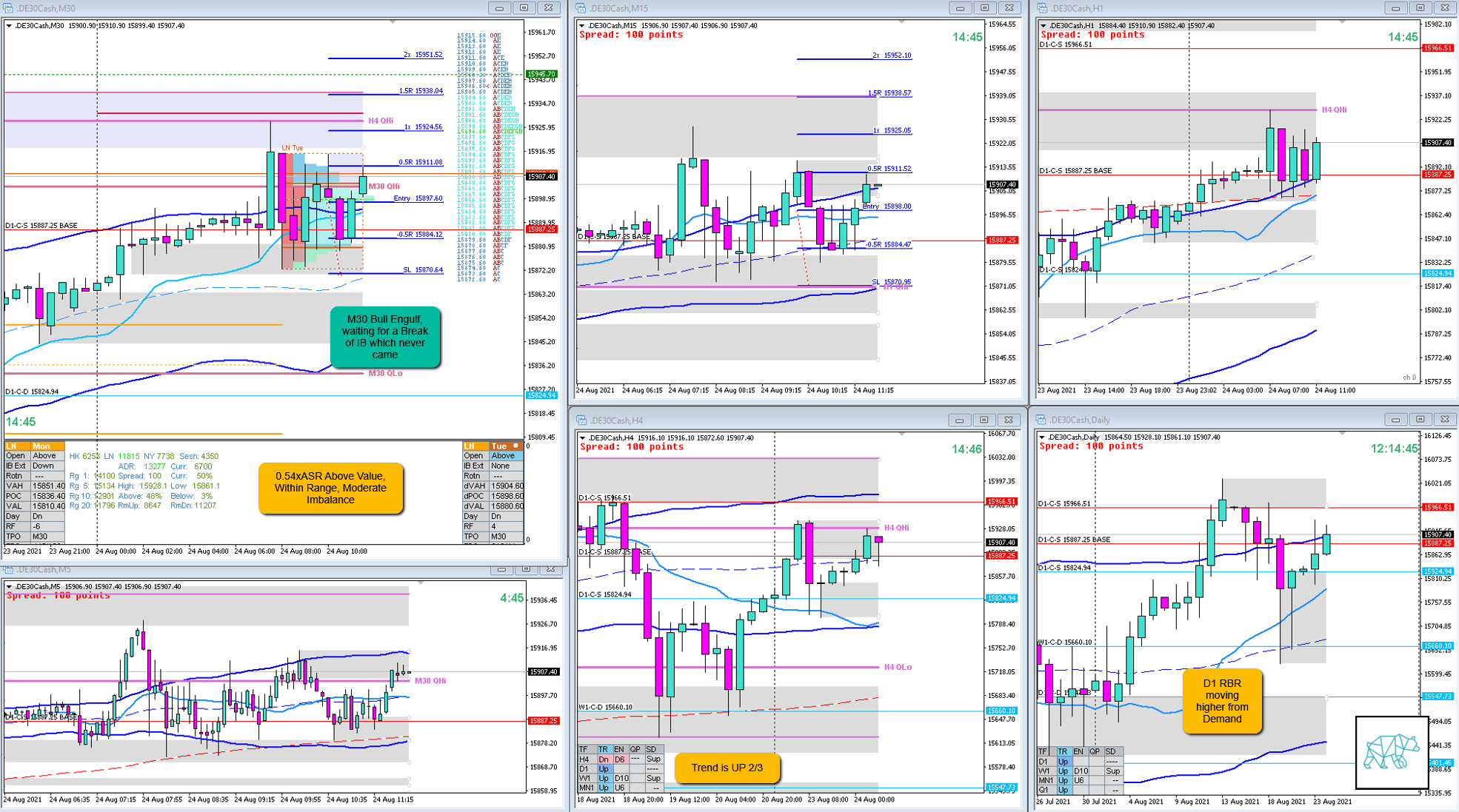

Preceding day had formed a D1 RBR moving higher from Demand. There was a 2nd arrival at H4 QHi but due to the larger timeframe bullish narrative the sentiment was for H4 QHi not to hold.

0.54xASR open Above value, within range indicating moderate imbalance. LTF demand above VAH was cause for a possible bounce.

What hypo was it?

Hypo 1

Return to Value, Reversal within IBR at LTF demand otherwise a Failed Auction Long

This was well hypothesized.

How was the Entry?

Entry was off a M30 Bull Engulf in C waiting for a break of IB hopefully in D. This never came however.

How was the SL placement and sizing?

Standard SL size just below IB. This was okay.

How was the profit target?

This was okay if price had started taking out H4 demand.

How was the Exit?

Exit was good. I waited over 2 hours. Even when LTF PA showed a possible reversal against my trade I stuck with it going through OODA loops. I understood H1 was consolidating and M30 Demand had not yet been taken out thus the M30 Three Outside Down was to ne negated. Gladly so as I took 0.3R when I saw M5 faltering to make a new HH to break above the H1 consolidation. This was okay.

What would a price action-based exit have done for the trade?

0.3R

What would a time-based exit have done for the trade?

0.2R, 0.3R in Overlap Noise 1st cut off. Afterwards price moved lower and tested IB Low again.

What did I do well?

I did well to take the trade and then stick with the trade until price had shown me the trade idea was invalidated.

What could I have done better?

I think I did well here.

Observations

M30 is the best guide in most cases but it is the overall narrative that unfolds through OODA loops that gives a clearer picture.

Missed Opportunity

N.A.

TAGS: Above Value, Within Range, Trend is up 2/3, moderate imbalance,

Premarket prep on the day

Daily Report Card on the day

No Comments