20 Aug 20210819 Trade Review DAX

Play: Auction Fade

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

Market Narrative

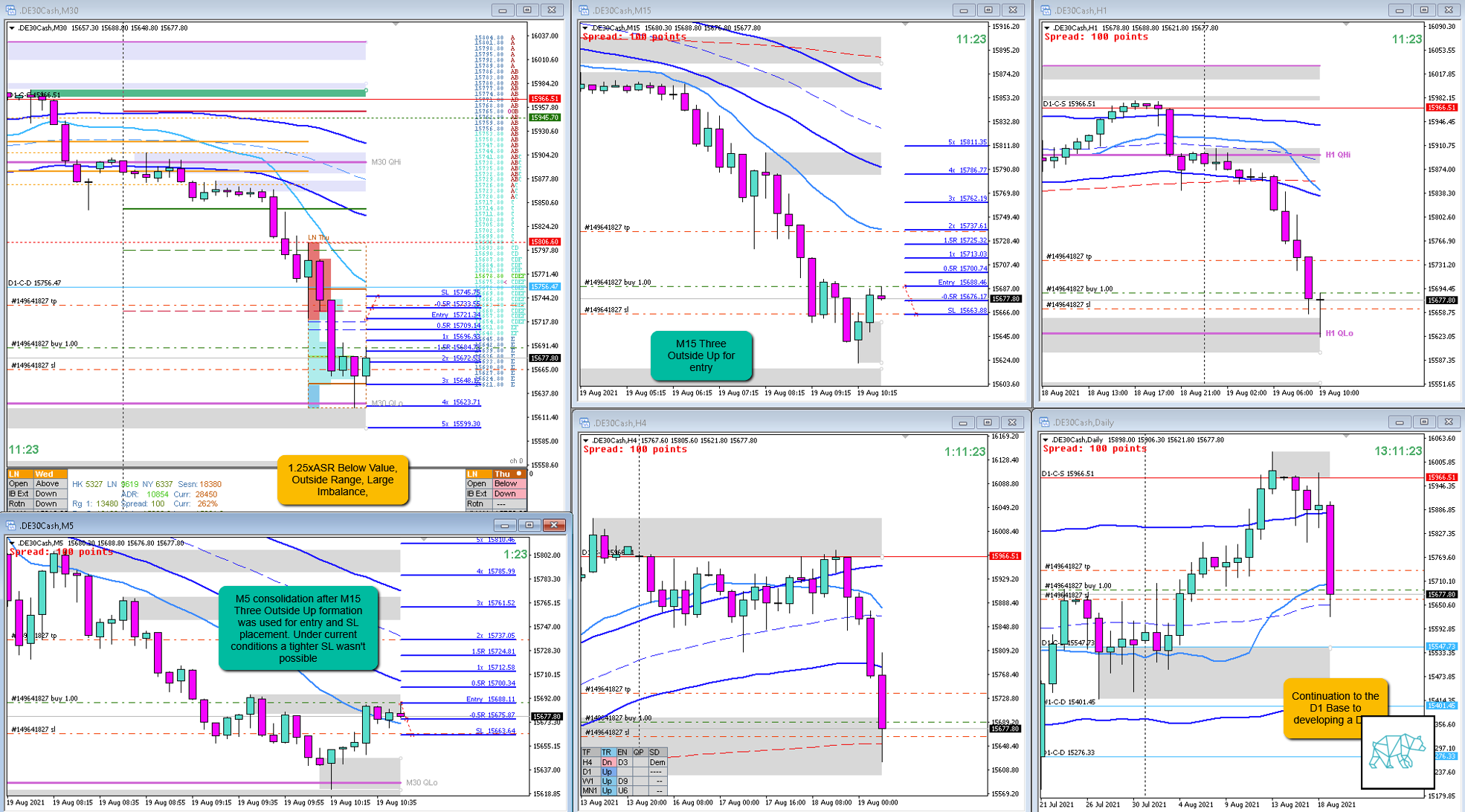

Price had sustained auction as per Hypo 1 then come 2nd DTTZ there was a reversal indicating a potential Auction Fade.

Price had opened 1.25xASR Below Value, Outside Range, Large Imbalance, so a mean reversion would be favored. As well as upwards bias in Equities.

What hypo was it?

Hypo 2

Mean Reversion, Auction Fade Long, variation to Hypo 1,

How was the Entry?

Entry was off the M15 Three Outside Up. Then I waited to see what M5 was doing and it started consolidating. The expectancy was if there was no break lower from LTF supply that there would be a continuation to the M15 formation as it is more a momentum formation ie a pullback to newly formed demand would be an exit signal.

I then monitored for a Single Print Fade of C TPO to confirm the direction.

How was the SL placement and sizing?

Using the M5 consolidation I was able to use a standard sizing. The market conditions did not allow for a tighter SL placement. This was the best I could do.

How was the profit target?

1.5R at IB low

How was the Exit?

WHen price came close to IB low I took 1R. There were 2 single prints left to IB low. Although I used altered TPO sizing so this could have gone a bit longer actually as was shown alter on. Price actually hit the low taking 1.5R.

What would a price action-based exit have done for the trade?

1.5R

What would a time-based exit have done for the trade?

1.5R due to price action overruling this one otherwise a stop out at ‑1R

What did I do well?

I did well to understand the narrative and take the setup. It is a bit tricky to get in on a M5 consolidation at a supply level.

What could I have done better?

I could have waited for IB low to actually get hit before taking profits.

Observations

N.A.

Missed Opportunity

N.A.

TAGS: Below Value, Outside Range, Large Imbalance, Trend is UP 2/3,

Premarket prep on the day

Daily Report Card on the day

No Comments