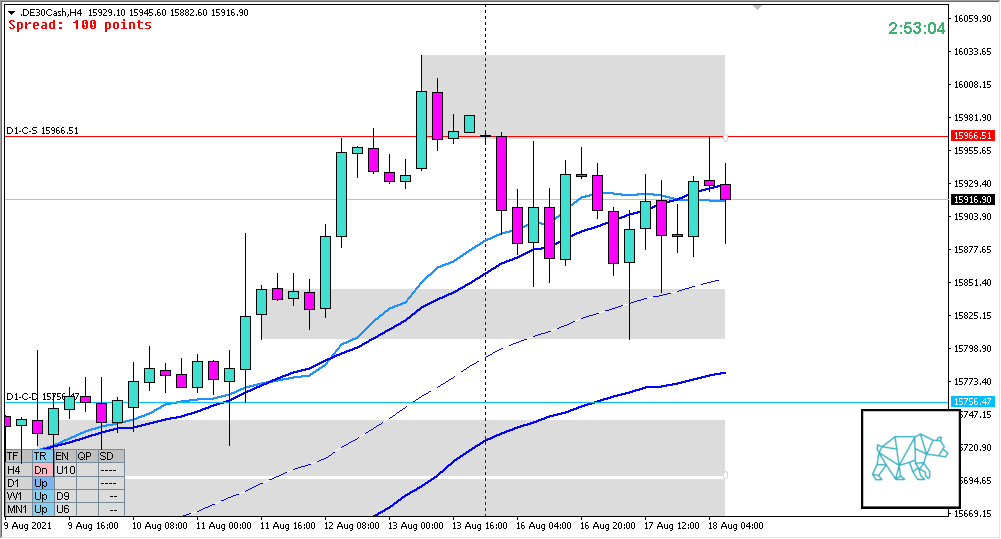

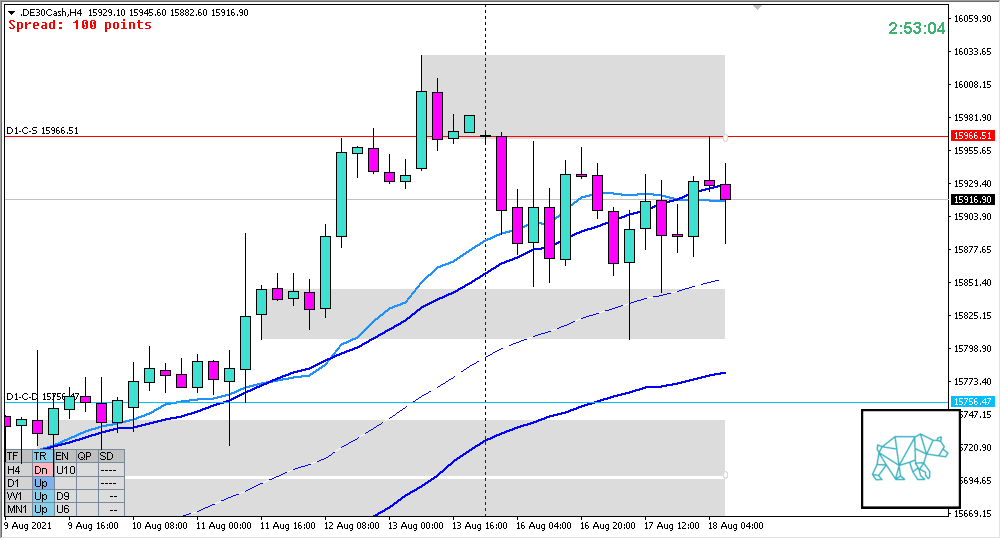

18 Aug 20210818 Premarket Prep DAX

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #index #indices #DAX #DE30Cash

This is my premarket prep for today’s European session for DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Compared against Weekly Trading Plan

- Price trading within last week’s body

Non-conjecture observations of the market

- Price action

- Some continuation down from D1-C‑S 15966.51 but with longer buying wicks

- Some H4 Phase 1 / 3

- Trend: H4 Down, D1 Up, W1 Up

- Prevailing trend: Trend is UP 2/3

- Market Profile

- 2‑day overlapping values after an uptrend formed below the high indicating a slowdown in price

- Daily Range

- ADR: 10846

- ASR: 9832

- 2458

- Day

- Yesterday’s High 15945.70

- Yesterday’s Low 15806.60

Sentiment

- LN open

- Above Value, Outside Range

- Open distance to value

- 0.26xASR

- Narrative

- Large Imbalance. Price took out some supply in premarket testing D1-C‑S 15966.51 before closing as a H4 Hammer. Price opened above value outside range so some mean reversion is possible. Although due to the still close proximity to value edge coupled with an H4 Hammer that took out supply there could be a H4 RBR developing. If price extends the opposite direction a potential H4 Evening Star.

- Clarity (1–5, 5 being best)

- 4

- Hypo 1

- Mean Reversion to Value Acceptance, Sustained Auction Down, late-sustained auction preferred

- Hypo 2

- Return to Value, Reversal at value edge or Failed Auction, demand within value possible bounce from within value

- Hypo 3

- Auction Fade Long, variation to Hypo 1

Additional notes

- Capital Preservation Rule in effect

ZOIs for Possible Shorts

- Not favored in equities

- D1-C‑S 15966.51

ZOIs for Possible Long

- D1-C‑D 15756.47

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Min. 3 times working out at home + mandatory cardio

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments