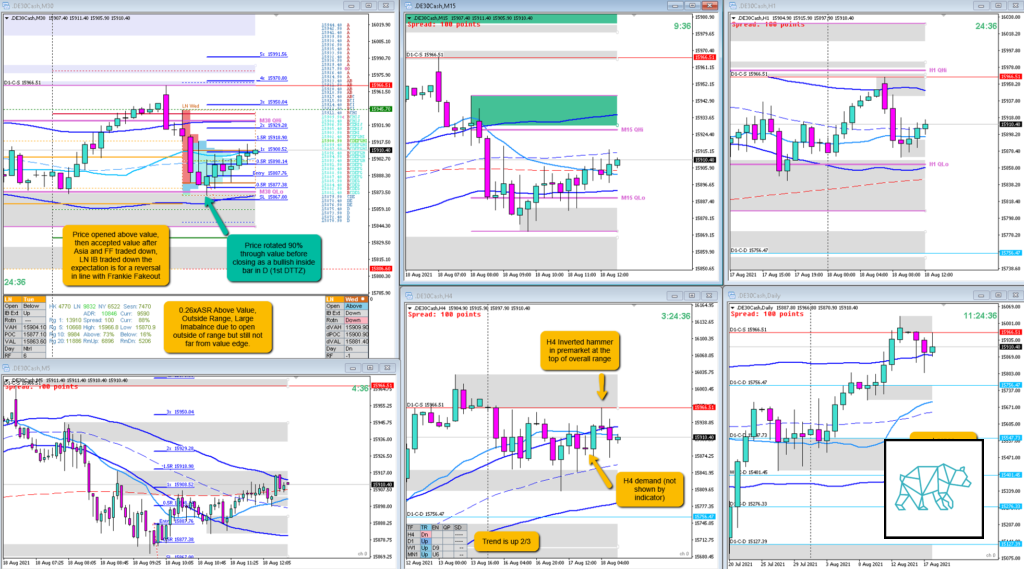

Play: Frankie Fakeout / Failed Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash #missedtrade

These are trades I could have taken but for some reason I did not. This could be due to me not paying attention or simply not feeling like trading. This is usually the case when I am not in the right state of mind due to lack of sleep, personal issues, etc.

Reason for missing the trade (explain the narrative)

Larger timeframe bullish sentiment. Pullback on D1. Open 0.26xASR above value, outside range. Large imbalance but still relatively close to value edge. Value got accepted but to go short in equities an open below value sentiment is more favored.

After price rotated about 90% through value hitting M30 QLo after C and D extended below the latter closed within IB as a Bullish Inside Bar. This was the entry signal.

I didn’t get in long as there were 2 TPOs that made a LL below IB and E had traded below IB as well so hesitated. I know that the actual play was a Frankie Fakeout setup coinciding with a Failed Auction.

What hypo was it?

Hypo 2

Return to Value, Reversal at value edge or Failed Auction, demand within value possible bounce from within value

What would have been the Entry?

Trade 1

DTTZ: 1st

Entry Method: M30 Bullish Inside Bar

How was the SL placement and sizing?

Trade 1

SL placement: I used a standard SL sizing in the screenshot but this could have been tighter creating a better R multiple. This is my main goal going forth. I need to get better R‑multiples to have a better expectancy.

How was the profit target?

Trade 1

Profit target: 2+ R at IB High

What would a price action-based exit have done for the trade?

Trade 1

Exit: 0.2R

What would a time-based exit have done for the trade?

Trade 1

Exit: 0.8

TAGS: above value, outside range, large imbalance, Frankie Fakeout, Trend is up 2/3,

Extra Observations

N.A.

Premarket prep on the day

Daily Report Card on the day