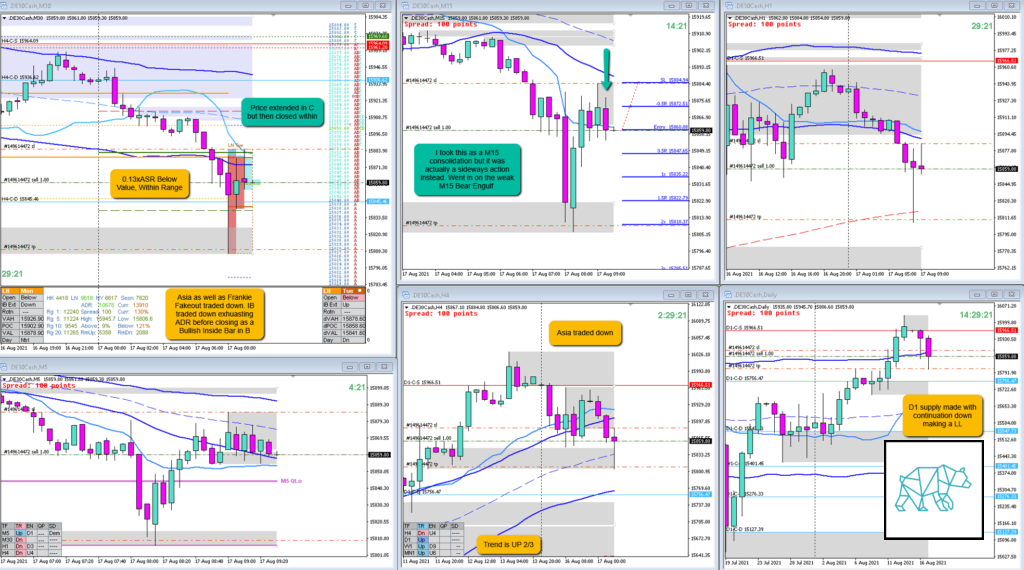

Play: Failed Auction, Reversal at Value Edge

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

Market Narrative

D1 supply was formed and the open sentiment was below value and within range. A continuation was possible. The M15 sideways I mistook for a consolidation with Bear Engulf finisher was merely sideways action. This coupled with the M30 long selling wick formation it was a very weak setup and thus a bad trading idea.

What hypo was it?

Return to value, value edge reversal or perhaps a Failed Auction probing value

How was the Entry?

Off a weak M15 Bear Engulf

How was the SL placement and sizing?

Standard sizing

How was the profit target?

2R would have been easily reached at IB low as is in line with a Failed Auction. Although I would have taken 1.5R as there was LTF demand at IB low.

How was the Exit?

When M15 closed as a Bullish Inside Bar instead I decided to let the trade go on a bit longer as DAX can be sluggish or seemingly indecisive before going short. When there was no bearish transition on M30 and M15 closed as a Three Inside Up I closed the trade for ‑0.7R.

What would a price action-based exit have done for the trade?

-1R

What would a time-based exit have done for the trade?

-1R

What did I do well?

I did well to wait for price action to confirm me to cut the trade.

What could I have done better?

I could have better recognized the situation as a sideways movement instead of a consolidation. Due to price trading at value edge and a failure to close within as well was a close deeper into IBR made me think of a bearish sentiment at the time.

Observations

Equities and Frankie Fakeout can supercede the conditions of a value acceptance. More about that in my next trade review post.

Missed Opportunity

Equities and Frankie Fakeout play that I will review in the next post.

TAGS: Below Value, Within Range, Moderate Imbalance, Value Edge Reversal,

Premarket prep on the day

Daily Report Card on the day