12 Aug 20210812 Trade Review DAX

Play: Reversal — Return to Value

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

Market Narrative

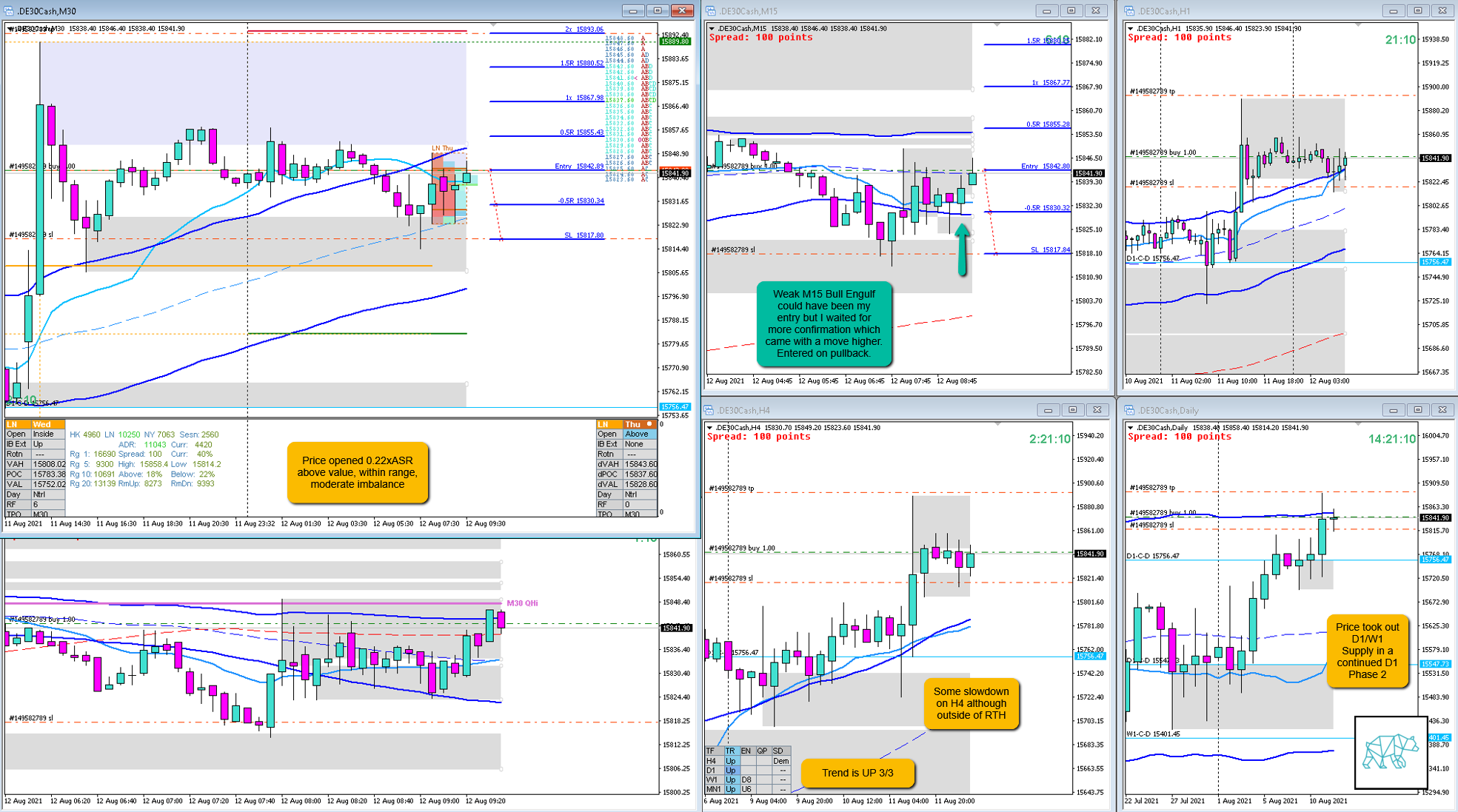

There was a continuation to D1 Phase 2 taking out D1/W1 Supply. Some slowdown outside of RTH. Open 0.22xASR above value, within range, moderate imbalance. Some LTF demand at VAH.

How was the Entry?

Entry was okay. I could have jumped in on the weak-ish M15 Bull Engulf but decided to wait for a little more confirmation. When price continued higher I waited for a slight pullback and went long.

How was the SL placement and sizing?

I could have scaled my SL better as this was placed on a standard size too far below IB. This could have been tighter right below IB. This way I would have had a better R‑multiple target as well.

How was the profit target?

Expecting a transition to a sustained auction up the profit target would have been okay.

How was the Exit?

Price gapped up due to liquidity issues which made me squirm a little bit. I got hesitant to keep the trade on longer and took 1R when it hit.

What would a price action-based exit have done for the trade?

Price would have hit 2R with relative ease before rolling over.

What would a time-based exit have done for the trade?

1.8R, 1.45 at overlap noise cut-off

What did I do well?

I did well to understand the narrative and go long at a pullback to the LTF demand at VAH reversal from within IB before waiting for an IB extension.

What could I have done better?

I could have let the trade go on longer but with summertime trading and lack of confidence in the liquidity gap I think I did fine here.

Observations

Low liquidity can cause intrasession gaps.

Missed Opportunity

N.A.

TAGS: Trend is UP 3/3, Above Value, Within Range, moderate imbalance,

Premarket prep on the day

Daily Report Card on the day

No Comments