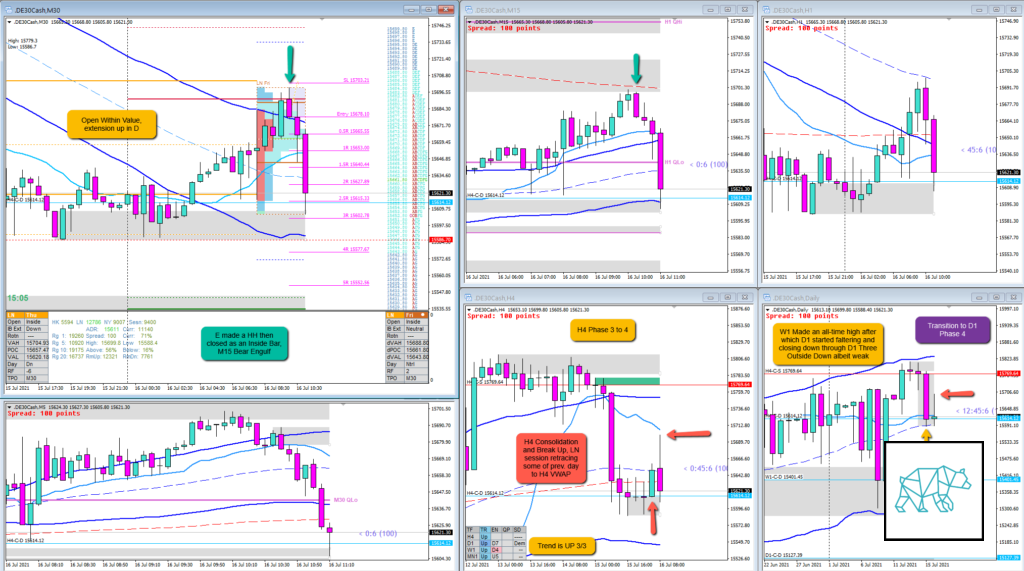

Play: Failed Auction From Within Value

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash #missedtrade

These are trades I could have taken but for some reason I did not. This could be due to me not paying attention or simply not feeling like trading. This is usually the case when I am not in the right state of mind due to lack of sleep, personal issues, etc.

Reason for missing the trade (explain the narrative)

Prev. Day Exceeded ADR by 1.24x. H4 consolidated at D1 50MA in UT and broke up. With the previous day having exceeded ADR and the general long bias of equities the sentiment was Bullish. Price opened within Value and IB traversed higher 0.52xASR. D extended and closed above IB but did not coincide with a rejection of value. E TPO made a HH and then proceeded to close within IB coinciding with a M15 Bear Engulf.

The reason that I did not take this trade is because I did not include it in my hypos but also because there were 2 TPOs that extended above IB making a Failed Auction less probable. Equities having a long-bias, and trend is up 3/3.

Even though at the time I did think this was going to run through IB due to the D1 narrative. The D1 narrative was a possible Phase 4 and continuation to the move after a pullback to H4 VWAP.

What would have been the Entry?

Trade 1

DTTZ: 2nd

Entry Method: M15 Bear Engulf coinciding with M30 closing within IB leaving a selling tail in E.

How was the SL placement and sizing?

Trade 1

SL placement: Slightly Tighter SL which wasn’t needed due to the size of the IBR. SL was above the formation.

How was the profit target?

Trade 1

Profit target: 2.5R at IB low with tighter SL placement

What would a price action-based exit have done for the trade?

Trade 1

Exit: 2.5R

What would a time-based exit have done for the trade?

Trade 1

Exit: 2.2R, 2.8R at overlap noise cut, although not valid because profit target is IB low

TAGS: Prev. Day Exceeded ADR, Open Within Value, All-Time High, Possible H4 Phase 3 to 4, Possible D1 Phase 4, Trend is UP 3/3,

Extra Observations

After having made an All-Time high there can be a sell off look for signs on lower timeframes.

Premarket prep on the day

Daily Report Card on the day