Play: Value Rejection Up, sustained auction, low initiative activity

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GOLD #XAUUSD

Market Narrative

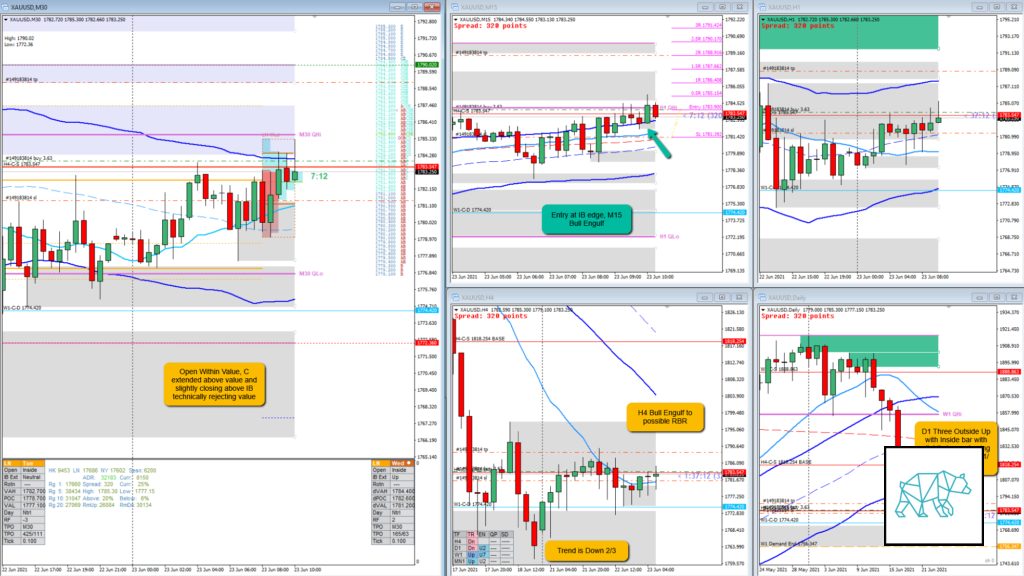

D1 Three Outside Up to Inside Bar with slightly longer buying wick possibly forming a RBR. H4 Bull Engulf possibly forming a RBR. Open inside value. C TPO closing above IB and VAH technically rejecting value.

How was the Entry?

I thought getting an entry at IB edge was good but what would have been better was an entry at VAH as price had failed to close below it but was testing it in a low initiative activity sustained auction day.

How was the SL placement and sizing?

SL could have been slightly better as price was more prone to dip within IB before continuing higher in a slow crawl. Price had not closed within M30 demand indicating the slow sustained auction still being on.

How was the profit target?

Not the best, but if I had a better entry this would also have been better.

How was the Exit?

M15 formed a bullish inside bar, possibile consolidation. Because of this I let it go longer for a litter. I visualized if M15 demand gets taken out I would take the trade off and I did for ‑0.7R. Now, I know that since M30 hadn’t closed within its demand I could have let the trade on a little longer even though it closed as a doji with long selling wick within IB.

What would a price action-based exit have done for the trade?

I would have scratched due to a lousy entry.

What would a time-based exit have done for the trade?

Scratched

What did I do well?

I did well to take the trade

What could I have done better?

Due to nearby supply I could have gotten a better entry expecting some probing back into IB.

Observations

N.A.

Missed Opportunity

N.A.

TAGS: Trend is DOWN 2/3, Open Within Value,

Premarket prep on the day

Daily Report Card on the day