23 Jun 20210622 Trade Review DAX

Play: Value Acceptance to Failed Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

Market Narrative

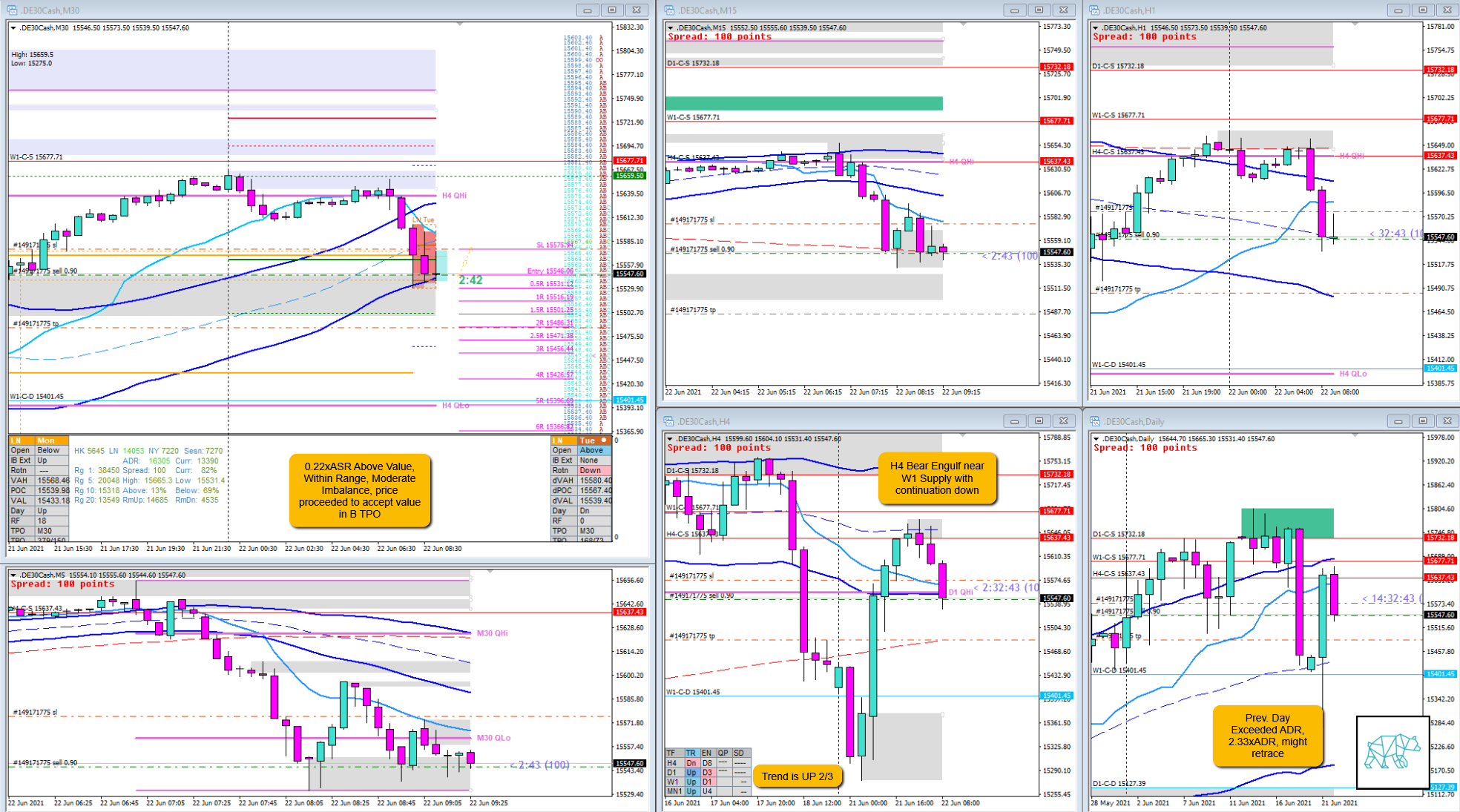

There was a 0.22xASR open Above Value, Within Range. Moderate Imbalance. Close proximity to value edge, possibility for value acceptance after coming from H4 QHi and newly formed H4 supply. Big move yesterday (38000 compared to ADR 16305, 2.33xADR), could retrace.

How was the Entry?

Th entry was bad. I gathered to not enter based on the value acceptance but instead I took a paper trade on a pullback to value edge. This turned out to have been a great entry. I did not want to take the trade short based off the VAA due to equities often times testing value and reversing at a LTF SD zone. Since there was a LTF demand within value not far from VAH, this coupled with upwards bias in equities, I decided it was not worth it.

Then Dee suggested to me to go short anyway since there was enough ASR left in the session and a possibility for continuation on the VAA.

Better Entry

How was the SL placement and sizing?

SL placement could have been better above the wick of the vandal that accepted value. Expecting some momentum/strength behind the trade I did not take this into consideration. I gathered that if the trade came back probing above the body it would invalidate the trading idea. Also, the SL size was also slightly tighter than a standard SL size.

How was the profit target?

In case of a full value rotation this could have had a profit target of 3.5R. I would have taken 2R depending on the single prints left on the profile.

How was the Exit?

At first it looked like it wanted to probe down and my trade went to 1R before running into buyers within the aforementioned LTF demand within value. M30 closed as a pinbar / M15 Bullish Inside Bar / H1 Neutral candle but did close lower. Since M30 had not made a full reversal pattern I decided to let the trade go a bit longer and see if the next TPO would close below.

E traded higher against my direction completing a M15 Three Outside Up and transitioned into a M30 Bull Engulf. Under normal circumstances this would have invalidated the trading idea due to the failed auction. This move had already taken out my SL for ‑1R.

Due to the VAA and W1 bear engulf prior week, as well as the big up day the day before the trading idea could have still been valid. I had placed my SL slightly too tight and the next candle retraced the full length of the previous.

What would a price action-based exit have done for the trade?

-1R got stopped out.

What would a time-based exit have done for the trade?

-1R Would have gotten stopped out as price reversed based on the Failed Auction and completed the move higher to IB high. Even extending to forming a Neutral Day.

What did I do well?

I did well to try out a short based on the VAA and the larger timeframe premise. Even though I was stalking a long trade based off the LTF demand.

What could I have done better?

If I was gonna do a value acceptance (VAA) trade I should have taking it on the pullback to VAH. This would have been a great entry.

I could have identified the trade based on my own analysis that the trade wasn’t working out.

Being in a DD I could have taken the 1R profit at least.

Hindsight is 20/20 as they say so never mind. I did well to take the trade and try out trading the crazy bunny that is DAX.

Observations

When there is a huge day preceding it that exceeds the ADR for the day, there can often be a retracement of that day’s candle.

Missed Opportunity

A Failed Auction trade probing LTF demand within value.

TAGS: Prev. Day Exceeded ADR, Above Value, Within Range, Moderate Imbalance, Trend is UP 2/3,

Premarket prep on the day

Daily Report Card on the day

No Comments