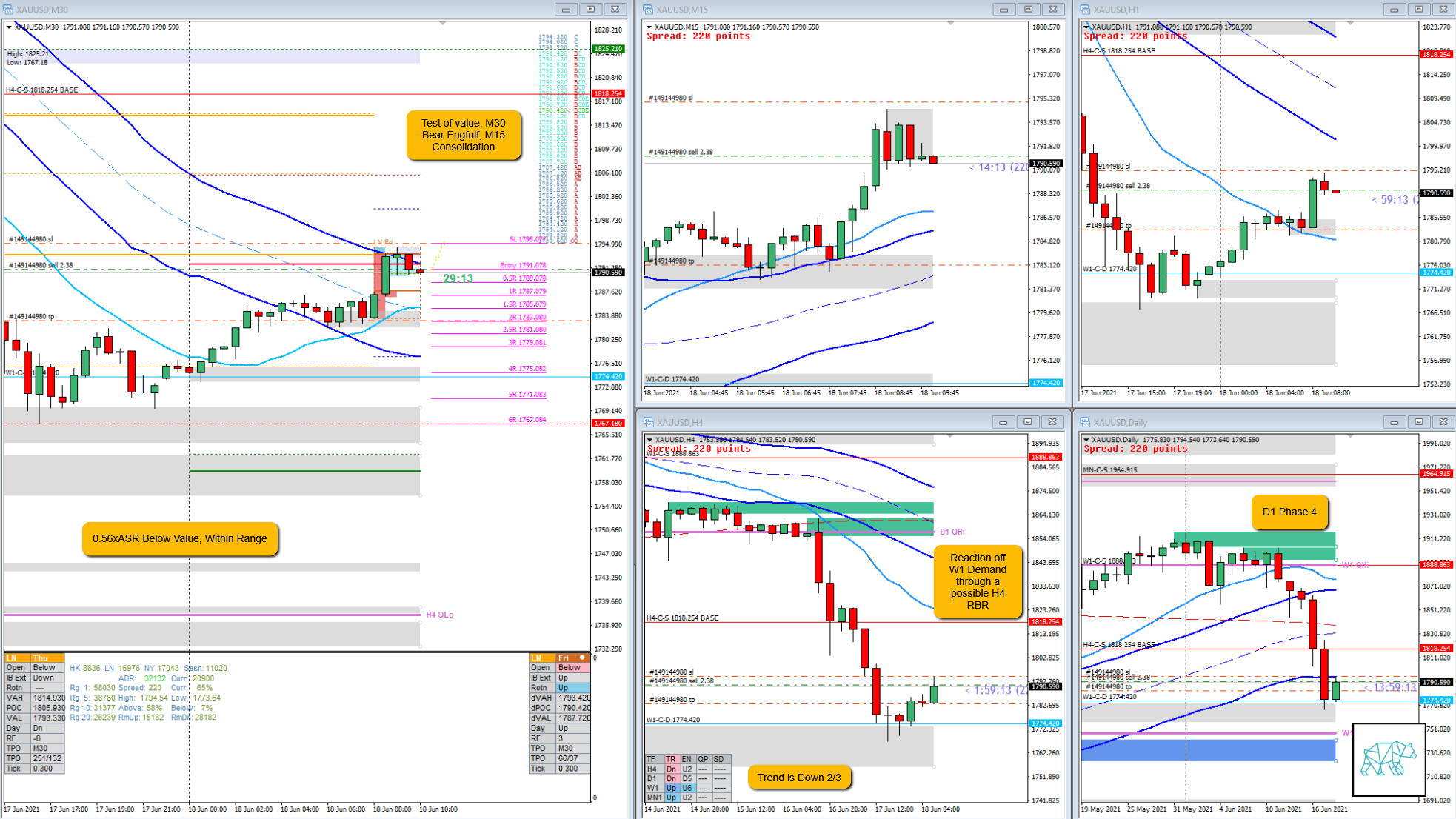

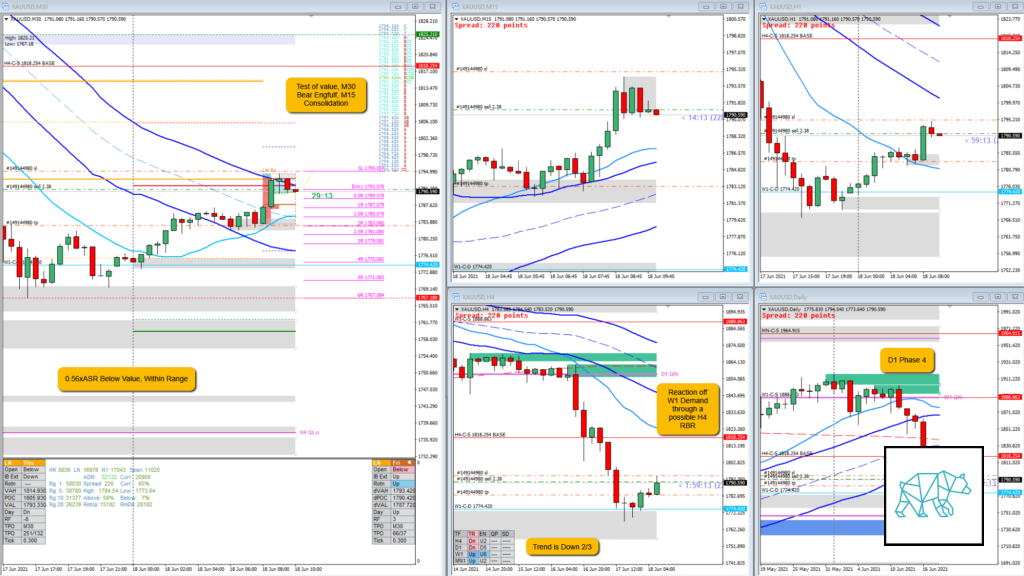

21 Jun 20210618 Trade Review GOLD

Play: Failed Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GOLD #XAUUSD

Market Narrative

Price opened 0.58xASR Below Value, Within Range. Price then tested value before closing as a M30 Bear Engulf within IB failing auction. A big con was that there was a weak selling tail and preferably this should have been longer.

How was the Entry?

Right on the close of the Bear Engulf in D.

How was the SL placement and sizing?

SL placement was good as it was right above the formation not exceeding the standard SL size.

How was the profit target?

2R at IB low

How was the Exit?

I got stopped out (down ‑1R) as price did not traverse down. This was evident in price failing to probe lower. Usually a Failed Auction goes quite quick.

What would a price action-based exit have done for the trade?

N.A. Got stopped out.

What would a time-based exit have done for the trade?

N.A.

What did I do well?

I did well to take the trade based on a test of value and failed auction

What could I have done better?

I think I did well to try a trade. Now I know the weak selling tail could have warranted a further investigation of OODA loops to see if there was a continuation down.

Observations

Failed Auction play should preferably have a longer selling/buying tail.

Missed Opportunity

N.A.

TAGS: D1 Phase 4, Trend is Down 2/3, Below Value, Within Range,

Premarket prep on the day

Daily Report Card on the day

No Comments