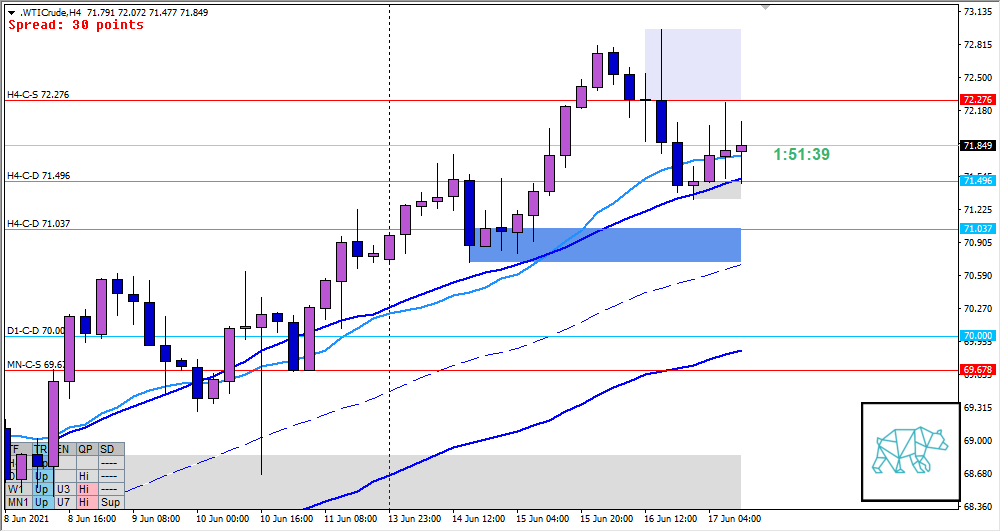

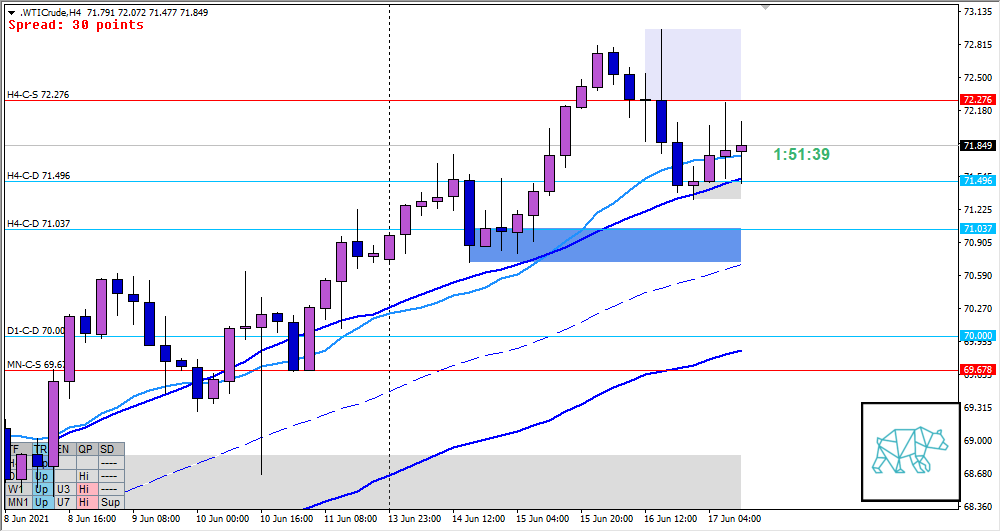

17 Jun 20210617 Premarket Prep WTI Crude NY

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #oil #crude #WTI #USoil

This is my premarket prep for today’s NY session for WTI Crude. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Compared against Weekly Trading Plan

- Price still trading above last week’s body and range with some reaction off W1-C‑S 73.340 although no touch

Non-conjecture observations of the market

- Price action

- D1 Bearish Inside Bar

- H4-C‑S 72.276 formed and tested before closing as a spinning top slightly higher but with long longer selling wick

- Trend: H4 Up, D1 Up, W1 Up

- Prevailing trend: Trend is UP 3/3

- Market Profile

- Flimsy bracket but values still sloping up

- Daily Range

- ADR: 1231

- ASR: 1105

- 280

- Day

- Yesterday’s High 72.961

- Yesterday’s Low 71.396

Sentiment

- NY open

- Below Value, Outside Range

- Open distance to value

- 0.26xASR

- Narrative

- Slight Gap down. D1 Bearish Inside Bar with an open below sentiment there could be more downside. Overruled in case of a value acceptance. Trend is UP 3/3

- Clarity (1–5, 5 being best)

- 4

- Hypo 1

- Return to value, VAL Reversal, Sustained Auction Down

- Hypo 2

- Value Acceptance, not good profit target due to Supply within value

- Hypo 3

- Failed Auction Short, probe above IB to value and supply

- Hypo 4

- Sustained Auction up, possible late-sustained auction entry

- Hypo 5

- Auction Fade Short, variation to Hypo 2

Additional notes

- Capital Preservation Rule in effect

ZOIs for Possible Shorts

- H4-C‑S 72.276

ZOIs for Possible Long

- H4-C‑D 71.496

- H4-C‑D 71.037

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Min. 3 times working out at home + mandatory cardio

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments