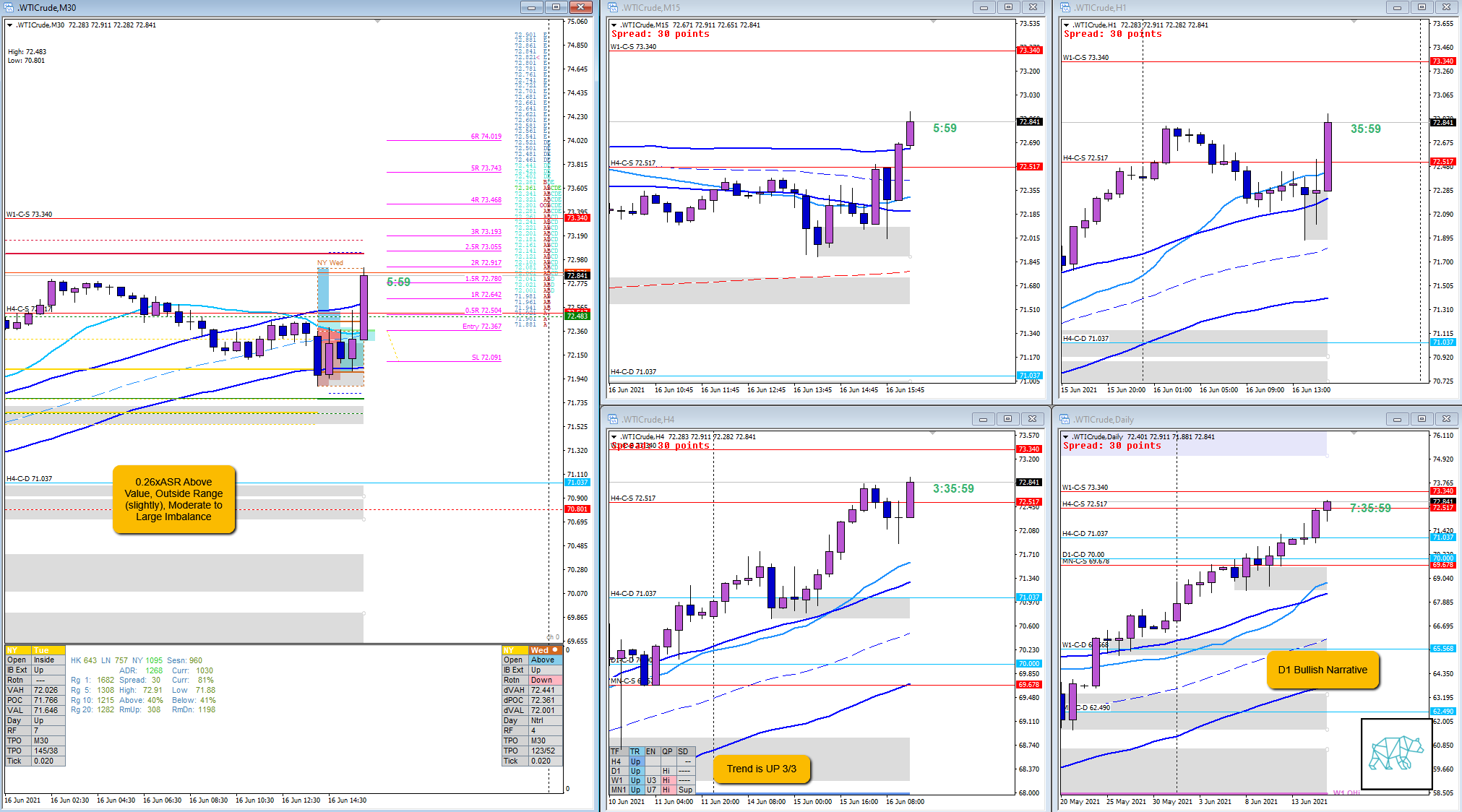

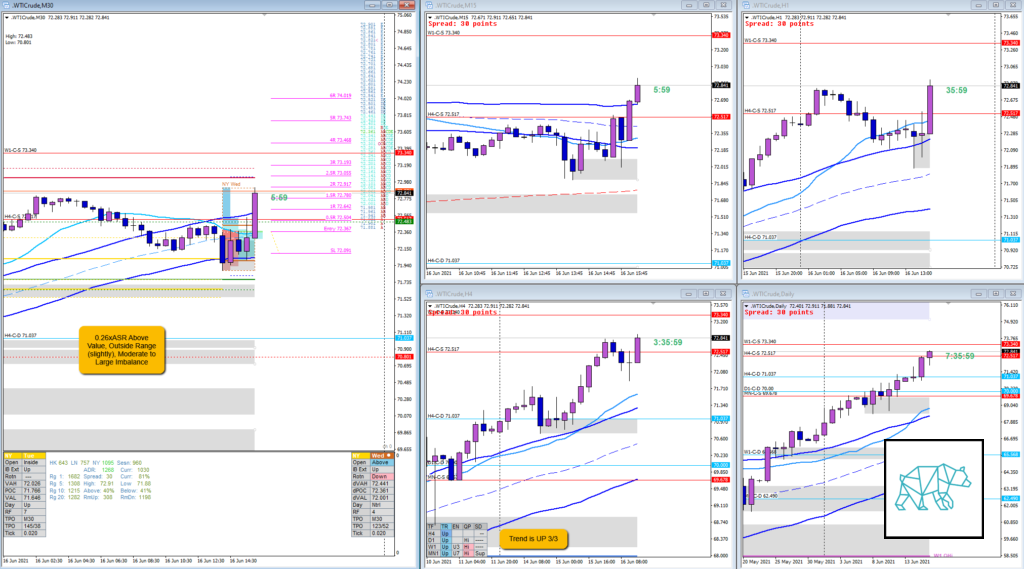

17 Jun 20210616 Missed Trade WTI Crude

Play: Sustained Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #missedtrade #oil #crude #WTI #USoil

These are trades I could have taken but for some reason I did not. This could be due to me not paying attention or simply not feeling like trading. This is usually the case when I am not in the right state of mind due to lack of sleep, personal issues, etc.

Reason for missing the trade (explain the narrative)

First time watching EIA inventories come out. It was bullish news.

0.26xASR Above Value, Outside Range (slightly). Price probed value edge during IB. D extended above IB then closed within as a Bull Engulf.

What would have been the Entry?

IB extension in D

How was the SL placement and sizing?

SL below formation body

How was the profit target?

Trading right into the newly formed H4 supply could have been negated as it was a Three Inside Down. WHen price retraces a formation like this it has a higher probability of failing and potentially moving higher.

What would a price action-based exit have done for the trade?

2R would have hit

What would a time-based exit have done for the trade?

N.A.

TAGS: Above Value, Outside Range, Moderate to large Imbalance, News Report, Trend is UP 3/3,

Extra Observations

N.A.

Premarket prep on the day

Daily Report Card on the day

No Comments