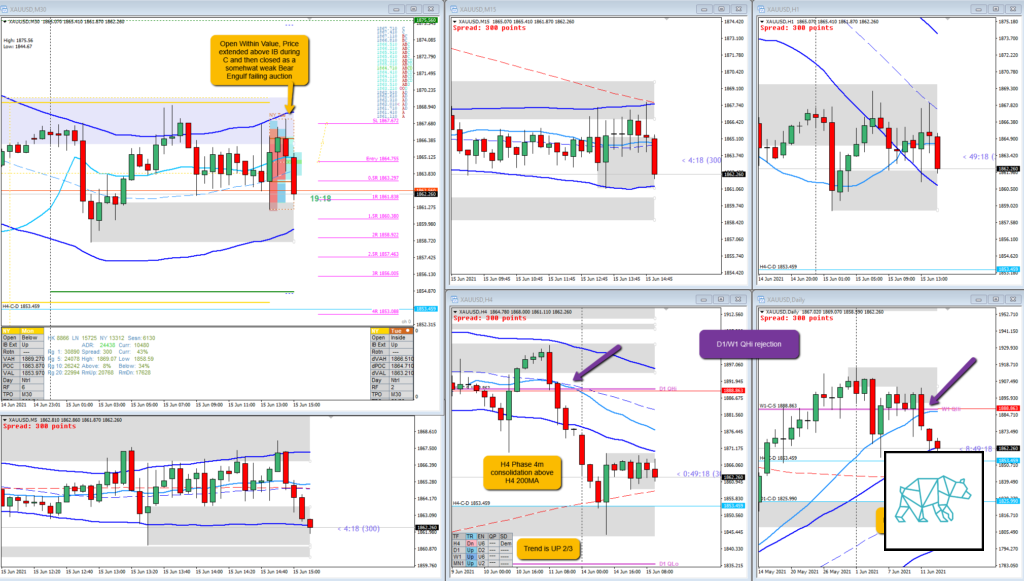

Play: Failed Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GOLD #XAUUSD

Market Narrative

Possible D1 Phase 4. H4 Phase 4, formed a BUll Engulf at H4 200MA without continuation higher. Instead a consolidation in line with possible D1 Bearish narrative. Also price coming from W1/D1 QHi rejection.

How was the Entry?

Entry was good off the C TPO closing as a Bear Engulf within IB failing auction.

How was the SL placement and sizing?

Standard size SL. I could have scaled slightly better expecting a push behind the failed auction move. This would have resulted in a better R multiple.

How was the profit target?

1.2R at IB low. Again, this could have been slightly better if I had scaled my SL and sizing a bit better.

How was the Exit?

Exit was okay. Although I could have waited for a full move through IB to IB low but due to LTF demand at IB low I decided to take the trade off at 1R. Price proceeded to test IB low.

What would a price action-based exit have done for the trade?

1.2R at IB low

What would a time-based exit have done for the trade?

N.A.

What did I do well?

I did well to understand the narrative and take the trade.

What could I have done better?

If nitpicking I could have let the trade go on slightly longer but due to LTF demand and being ina DD I think I did well to take profits.

Observations

Failed auction from within value

Missed Opportunity

N.A.

TAGS: Possible D1 Phase 4, H4 Phase 4, Open Within Value,

Premarket prep on the day

Daily Report Card on the day