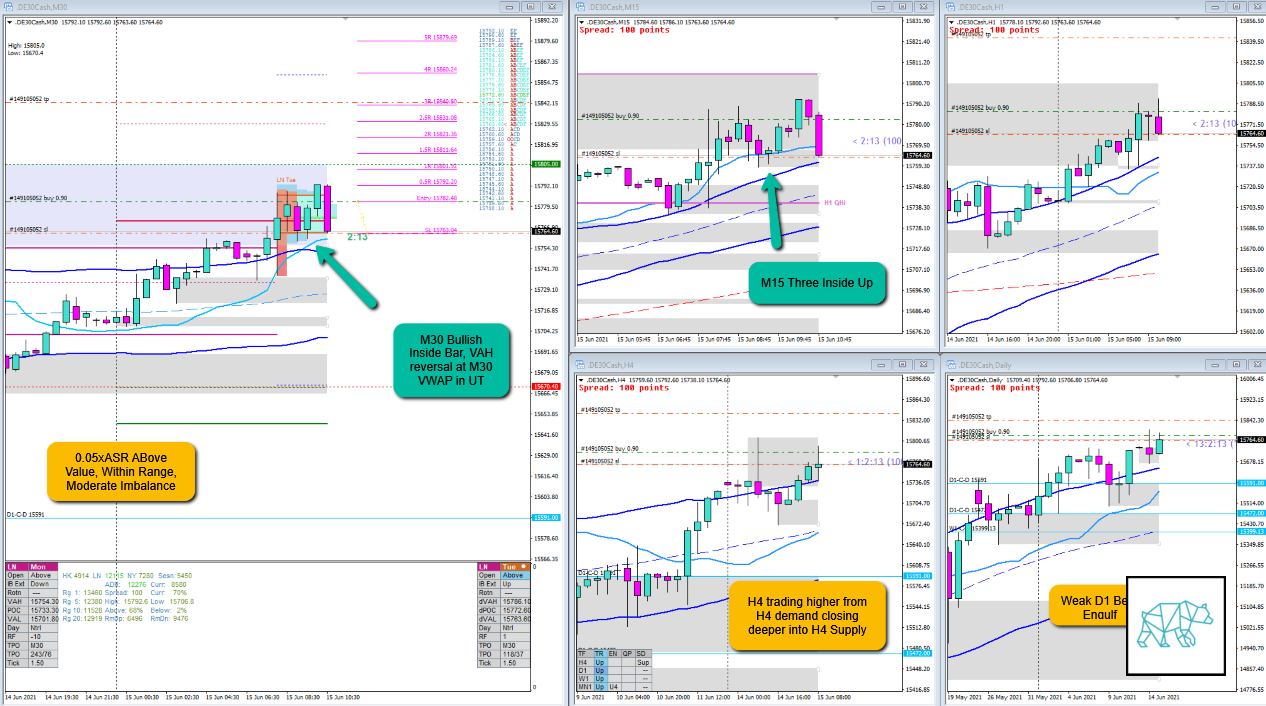

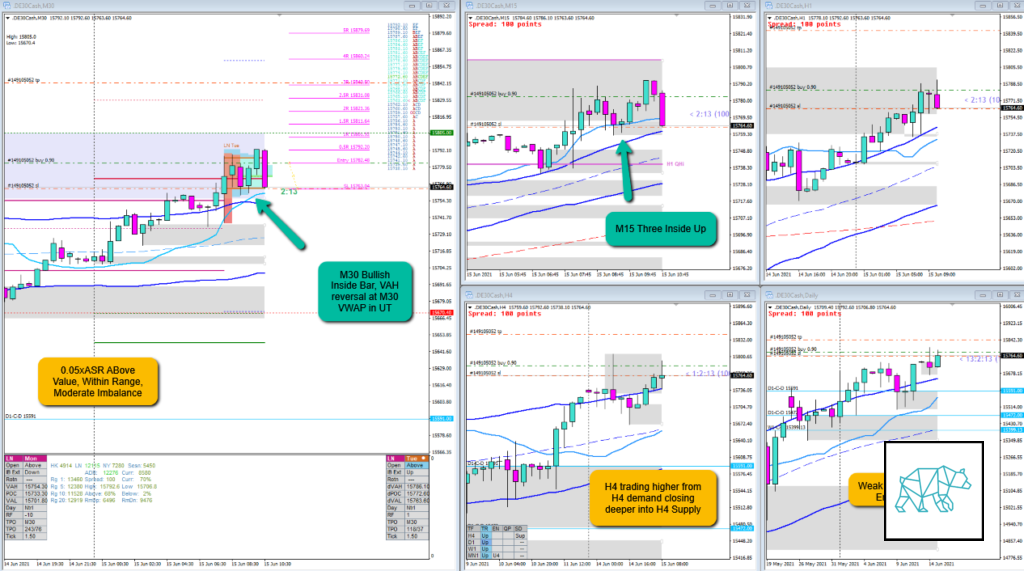

16 Jun 20210615 Trade Review DAX

Play: Sustained Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30Cash

Market Narrative

Price opened 0.05xASR Above Value, Within Range on moderate imbalance. Price traded higher during IB and pulled back in C to VAH and M30 VWAP in UT and closed as a M30 Bullish Inside Bar / M15 THree Inside Up. Equities being equities the bias is long.

How was the Entry?

Since this is my first time in a long time trading DAX I did not pay attention to this opportunity. Dee had pointed it out to me and I went in on a pullback to the move getting about the same entry if I had taken the M15 Inside Up. Price had pushed outside of IB during E and my entry was during F TPO. Not having experience with the asset I went in.

How was the SL placement and sizing?

At first it was not great. It was too wide. I was fumbling with FX synergy as well as I could not get the contract sizing right. When I managed that I had put in a standard size SL. This was pointed out to me that it was too wide. In a sustained auction play a SL below the body of the formation is good enough as we are expecting a push behind the move. Same as with a Failed Auction it is okay to cut through the wicks as we again are expecting a push behind the move.

I adjusted the SL but did not adjust my sizing as I had already no confidence in the move. This was due to an extension up during F. In FX this is usually a bad sign and we can expect a reversal. This, being equities I thought I’d give it a try.

How was the profit target?

In a sustained auction play we expect the price to go higher above IB in this case it would have given a good 2R.

How was the Exit?

My stop got hit quite quickly with a good push down in F closing as a Bear Engulf. I noticed there was a difference in orders getting closed between the two brokers I use which normally doesn’t happen as much. Must’ve been a spread-related issue. DUe to me fumbling with the SL placement earlier this one netted a ‑0.62R loss.

What would a price action-based exit have done for the trade?

SL got hit

What would a time-based exit have done for the trade?

SL got hit

What did I do well?

I did well to take a chance and get a trade in on DAX.

What could I have done better?

I could have had better SL placement from the start.

Observations

DAX likes Frankie Fakeouts. And if the move was significant it can have M15/M30 reversals for a momentum push and can be traded from within IBR. Not during IB.

Missed Opportunity

N.A.

TAGS: Above Value, Within Range, Moderate Imbalance, Value Edge Reversal, VAH Reversal,

Premarket prep on the day

Daily Report Card on the day

No Comments