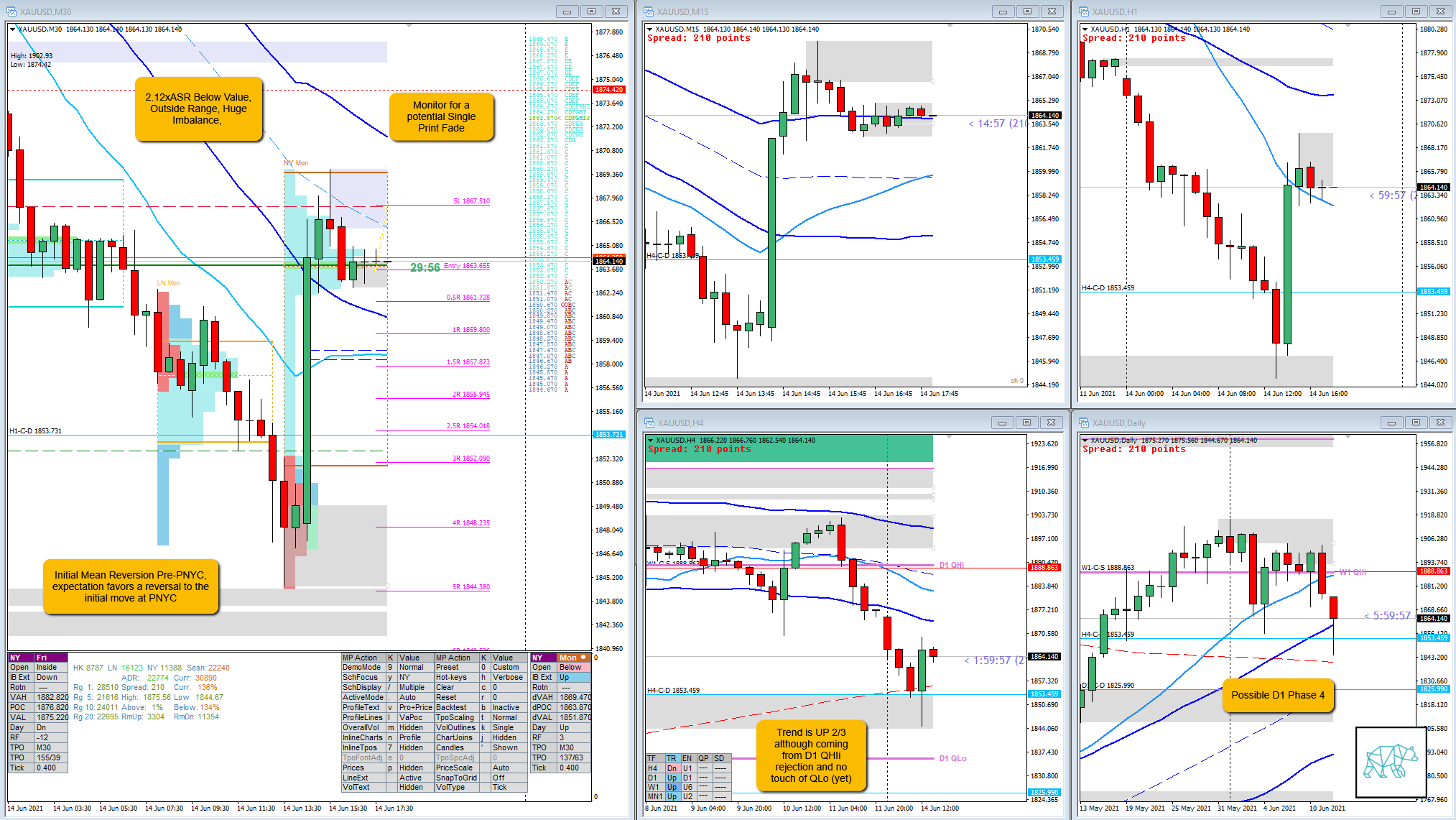

15 Jun 20210614 Trade Review GOLD NY

Play: Mean Reversion to Auction Fade

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GOLD #XAUUSD

Market Narrative

Price made a mean reversion move due to the open sentiment and hitting H4 200MA pre-PNYC. With PNYC reversal coming up and price faltering on LTF the sentiment is for a possible Auction Fade. Due to a possible D1 Phase 4, the H4 Bull Engulf can be somewhat negated.

How was the Entry?

Entry could have been better. I could have waited for more of a pullback. Even better so would have been an entry based on E TPO closing as an Inside Bar with long selling wick combined with M5/M15 faltering PA to get a better entry. Then monitor for a possible Single Print Fade.

I waited for a Single Print Fade before entering and didn’t even see it and just went in on the Three Outside Down.

How was the SL placement and sizing?

This was okay expecting a move further down and a retracement would have invalidated my trade idea.

How was the profit target?

2.8R at IB edge

How was the Exit?

Time-based as there was no Single Print Fade I cut it off. Scratched at ‑0.1R.

What would a price action-based exit have done for the trade?

Time-based overruled

What would a time-based exit have done for the trade?

-0.1R

What did I do well?

I did well to take the trade

What could I have done better?

I could have gotten a better entry as outlined above.

Observations

Using Single Print Fade as a continuation tool

Missed Opportunity

N.A.

TAGS: Possible D1 Phase 4, Trend is UP 2/3, Huge Imbalance, Below Value, Outside Range, Potential Single Print Fade

Premarket prep on the day

Daily Report Card on the day

No Comments