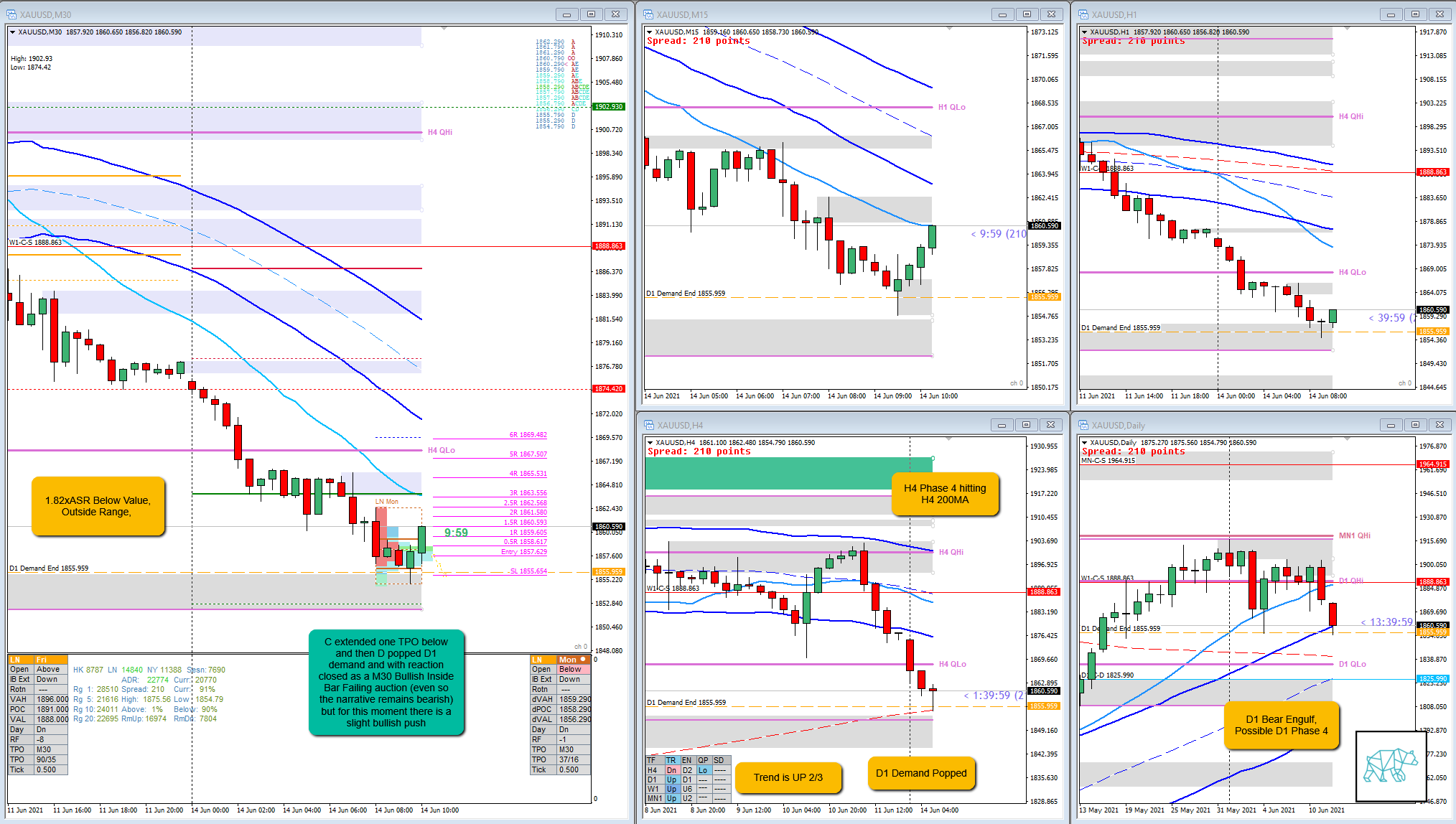

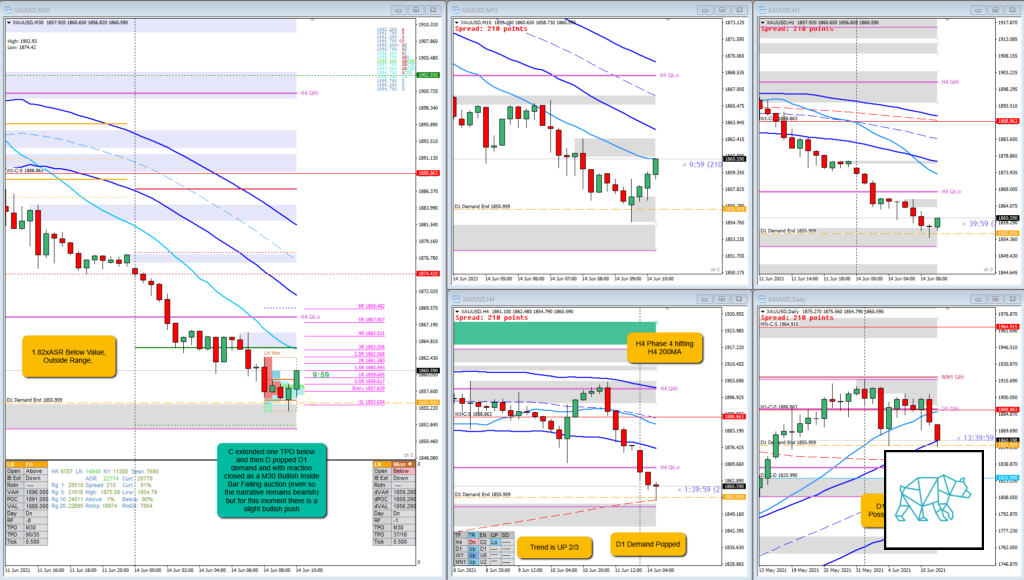

15 Jun 20210614 Trade Review GOLD

Play: Failed Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GOLD

Market Narrative

Huge Imbalance on the open sentiment and price extended below popping D1 demand. The popping of the demand created a LTF reversal short enough to hop on for a Failed Auction play.

How was the Entry?

The entry was good on a slight pullback to the M30 Bullish Inside Bar. Expectancy is a Three Outside Up formation.

How was the SL placement and sizing?

SL placement was good due to the expectancy of price to move higher due to the failed auction. Cuttin through wicks is allowed then to get a better R multiple based on the IBR.

How was the profit target?

Based on the IBR the R multiple was good as IB high would have yielded 2.5R.

How was the Exit?

Exit was good as I am in a slight drawdown and 1R trades are allowed. I decided to cut the trade off for 1.5R at M15 Supply coinciding with M15 VWAP in DT.

What would a price action-based exit have done for the trade?

To me this was price-action based.

What would a time-based exit have done for the trade?

It would have stopped out the trade as price quickly reversed and traded lower. ‑1R.

What did I do well?

I did well to take the trade

What could I have done better?

I could have been better with stalking the trade. I was fidgeting around with FX synergy. For every TPO close I will make sure that for the last 5 minutes I will be focusing on the close.

Observations

D1 Demand Popped showed another LTF reversal before continuing in the same direction.

Missed Opportunity

N.A.

TAGS: Possible D1 Phase 4, H4 Phase 4, Trend is UP 2/3, D1 Demand Popped, Huge Imbalance, Below Value, Outside Range, M30 Bullish Inside Bar, M30 Three Outside Up,

Premarket prep on the day

Daily Report Card on the day

No Comments