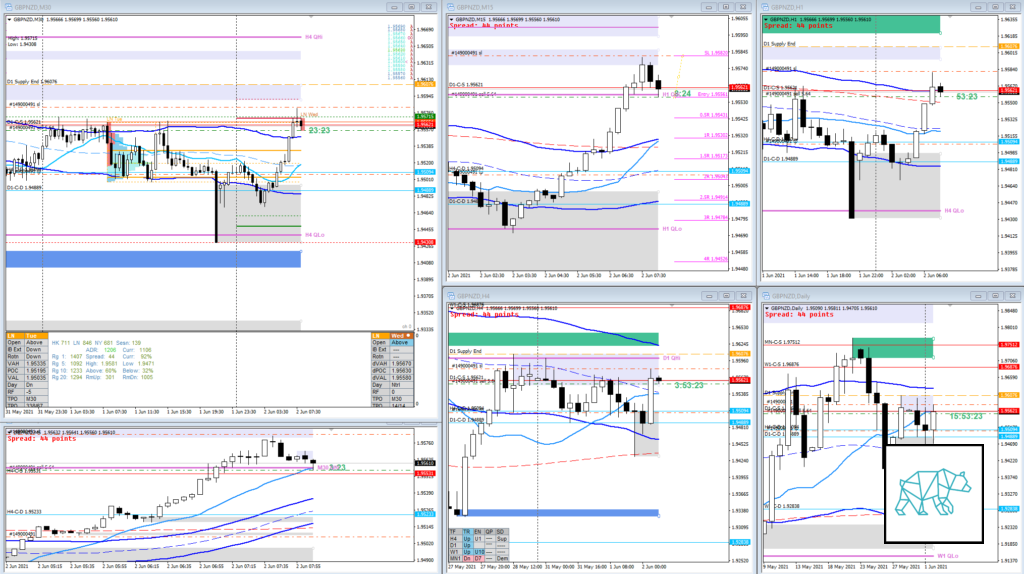

02 Jun 20210602 Trade Review GBPNZD

Play: Swing Reversal

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GBPNZD

Market Narrative

Price had opened slightly outside of range, above value at 0.4xASR, and had formed a Gravestone Doji in premarket at a D1 supply. I used the influx at London open for a potential push down going short during IB.

How was the Entry?

Not the best as I hesitated slightly due to the session just having opened. I usually don’t trade during IB.

TAGS: Trend is up, Above Value, Outside Range, Moderate Imbalance, IB extension down, Failed Auction, Poor Low, Tight ASR, Speedbump H1,

How was the SL placement and sizing?

SL placement was okay at x.xx82

How was the profit target?

1R at value edge

How was the Exit?

I had to cut off the trade for scratch (very minor profit) as I wouldn’t be able to monitor it. The AC repair guy showed up early.

What would a price action-based exit have done for the trade?

There was no PA exit rule but I would have taken 0.5R profit due to having taken the trade during IB and wanting to take a buffer trade.

What would a time-based exit have done for the trade?

-1R but would have never let the trade go on that long.

What did I do well?

I took the trade as part of my new goal to take more trades.

What could I have done better?

I could have focused on the better opportunity that came next. The Return to Value play.

Observations

Tight ASR makes for better directional reading on H1.

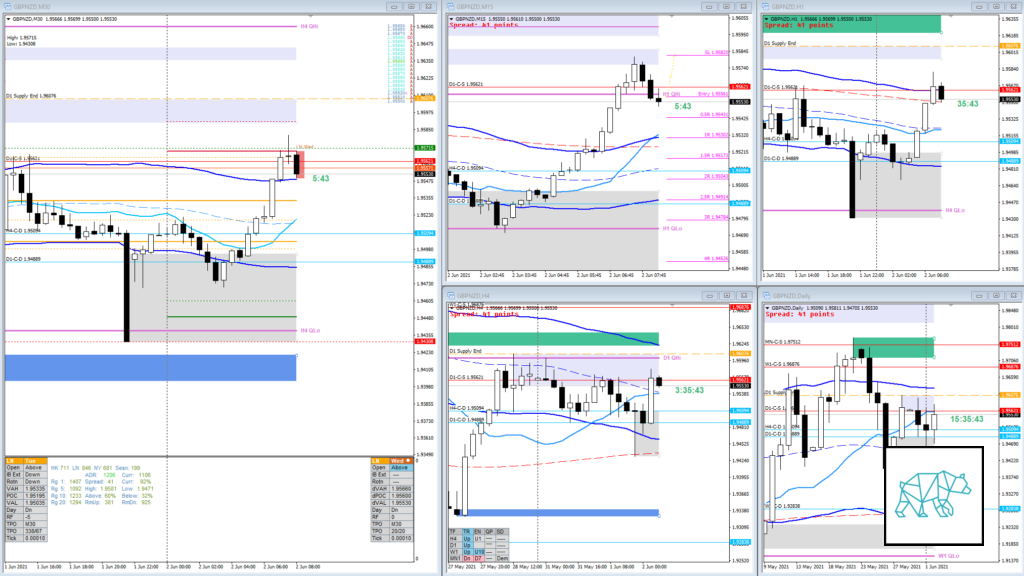

Missed Opportunity

Return to Value play

Premarket prep on the day

Daily Report Card on the day

No Comments