26 May 20210526 Trade Review GBPNZD

Play: Single Print Fade

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GBPNZD

I have already reviewed these trades but I like to go back and review them again. Hence this new format I am introducing into my process.

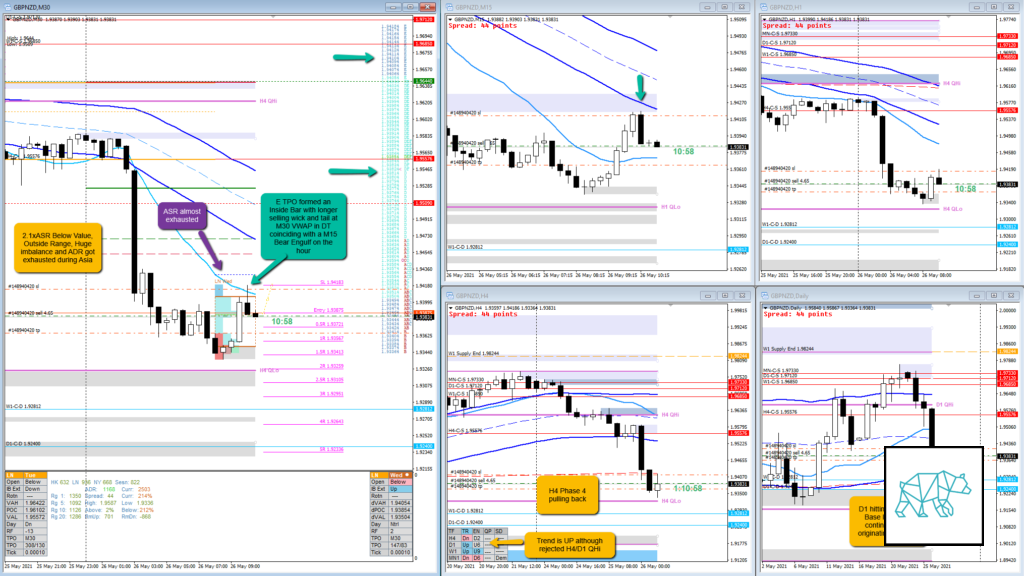

Market Narrative

There was an initial mean reversion in a H4 pullback after a quite confident close down on H4 in premarket. With D1 narrative of a potential continuation to originating level after hitting the D1 Demand Base Level there was a probability for a short opportunity. Price extended above IB then traded about 805% of ASR before closing as an Inside Bar with long selling wick in E leaving behind a long selling tail (M15 Bear Engulf on the hour).

How was the Entry?

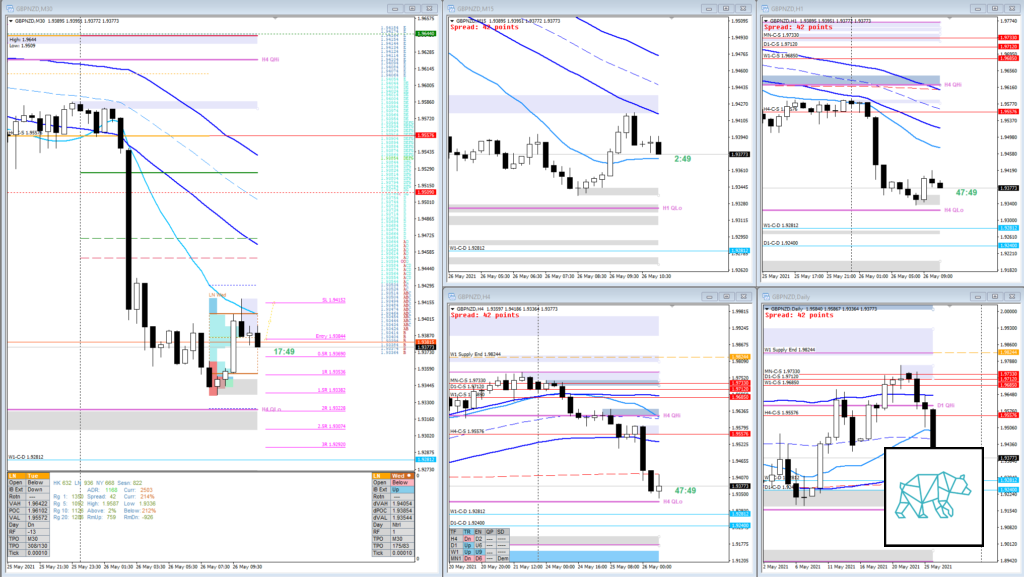

Entry was good. F TPO started taking out Single Prints in D but reversed a bit so I waited a little longer for a 2nd TPO to get taken out before I entered.

F closed as a Base further suggesting a continuation down. G then took it almost all the way to IB edge high.

TAGS: D1 Demand Base, Return to Base, Trend is UP, Developing H4 Base, Huge Imbalance, Below Value, Outside Range, ADR got exhausted, momentum trade, Single Print Fade,

How was the SL placement and sizing?

Even though it was cutting through the wick SL placement was okay due to expecting a somewhat quick move down to IB edge.

How was the profit target?

Buffer trade of only 0.6R at IB edge

How was the Exit?

Not great as price has just started taking out more single prints during G TPO and I took the trade off. Reasons for it being I felt quite uneasy about being in the trade due to the momentum first part of the session and not having a TPO structure before going against the move. I did well to take it though and at least banks a little for the buffer bank.

What would a price action-based exit have done for the trade?

0.6R at IB high

What would a time-based exit have done for the trade?

0.6R at IB high

What did I do well?

I did well to take the treat.

What could I have done better?

I could have let the profile eat up single prints at least a bit more till IB edge. Doesn’t have to reach entirely as it missed it by 1 TPO hence don’t be a dick for a tick.

Observations

H4 developing Base in a D1 Bearish narrative

Premarket prep on the day

Daily Report Card on the day

No Comments