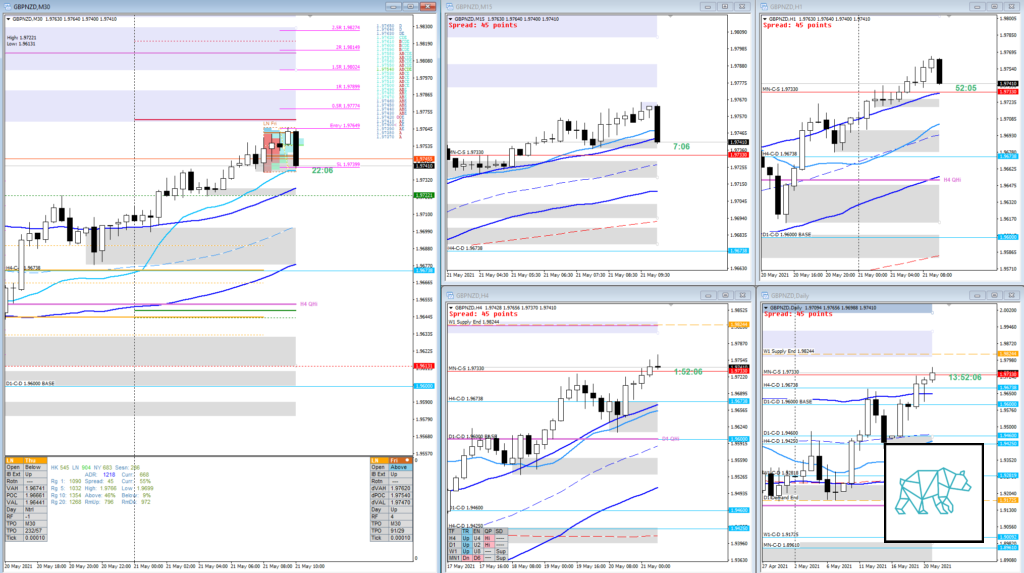

22 May 20210521 Trade Review GBPNZD

Play: Trend Continuation (fail)

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GBPNZD

I have already reviewed these trades but I like to go back and review them again. Hence this new format I am introducing into my process.

How was the Entry?

I put a Buy Stop Order above IB high about 4 pips higher so that it wouldn’t get triggered right after extending. When I had put the trade on I was doubting the move heavily and second-guessing if I am just putting this trade on to take a trade as I have been pushing myself to take more trades. I was considering to take the trade off before it got triggered with IB only extending 1 TPO. I committed to the trade and decided to wait and see. D closed above IB in what looked like a potential move to take price higher. I decided to stick with the trade for one more TPO and got taken out.

Two things very wrong about this trade: Price was trading at MN supply and there was a large imbalance at the open. My thinking at the time was that D1 Supply got taken out premarket coming off a D1 RBR there could be some continuation higher testing the next D1 Supply. This never came.

TAGS: Buy Stop Order, Above Value, Outside Range, Large Imbalance, D1 Supply Popped, Stop Hunting,

How was the SL placement and sizing?

Expecting a momentum trade so SL placement was good.

How was the profit target?

Enough space to next medium time frame supply

How was the Exit?

My SL got hit due to being in the wrong trade. The trade I should have been in was the Mean Reversion play as per Hypo 2.

What would a price action-based exit have done for the trade?

N.A.

What would a time-based exit have done for the trade?

N.A.

What did I do well?

Did well to take the trade even though it was a horrible horrible trade…. And I committed to the trade adhering to my exit rules.

What could I have done better?

I could have listened to my gut and not put on this trade and jumped in on the actual; play for the day which was a Mean Reversion trade. When I got stopped out I could have reversed the trade but I hesitated due to forming a Neutral Day. I kind of expected the trade not to move so far as it did. I was wrong.

Observations

At a larger timeframe SD zone with a large imbalance at the open there can be a slight fake out before reversing.

Also, price can ‘pop’ and take out orders just above IB: possible Stop Hunting

Missed Opportunity

Mean Reversion play. The actual play of the day.

Premarket prep on the day

Daily Report Card on the day

No Comments